This week there was one change in the model portfolio. We sold out of DRN on Thursday morning and entered into TECL.

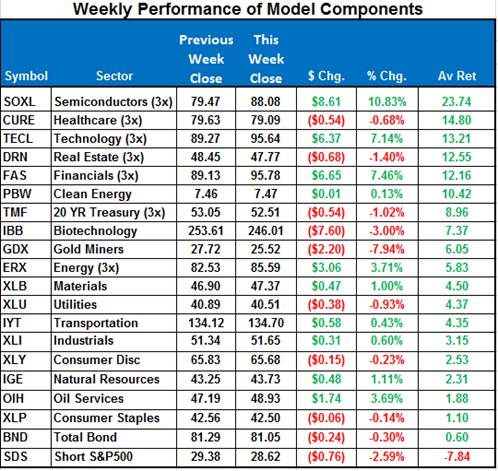

The top three sectors are Semiconductors, Healthcare, and Technology. The SPY closed the week almost as flat as possible, down -0.07%. The ETF model was up 2.8% for the week thanks to the tremendous outperformance of semiconductors. The ETF Sector Plus Strategy is up +14% year-to-date compared to the SPY which is up +0.35%.

This Week’s Strategy Lesson: Divergence

I thought we could take this week’s strategy lesson from Hollywood. Divergent open nationwide this weekend, but you don’t have to go to a theater to see divergence. It is on display in the markets all the time. In fact, it is one of the key principles that the ETF Sector Plus Strategy is built upon - the idea that different sectors can perform very differently in the same market.

Since 1990, the average annual return differential between the best and worst performing sector is around 50%. When you invest in an index fund, like the SPY, the performance you get is an amalgamation of the individual performance of all the major sectors represented.

That means the performance of the broad index is brought down by the underperforming sectors. The basis of any “sector rotation” strategy is to rotate in and out of sectors throughout the economic cycle to avoid the underperforming ones and get into the ones that are most likely to outperform.

Of course, determining which ones will outperform isn't easy. We have developed a proprietary indicator that helps our model determine which sectors we should remain top performers for a profitable period of time. And over the long run, the Model has made impressively accurate predictions.

Of course not every trade will work. Recently got into DRN (Real Estate) because it moved firmly into the third rank in our model. It has been climbing steadily in our ranking for a while, but took quite a haircut this week after FED Chairwoman Janet Yellen hinted at an earlier than expected date certain for a possible rate increase.

The divergent performance between DRN and our other top ranked ETFs this week became enough for the model to send a signal to sell out DRN. Sometimes even over short periods, this divergence can be significant.

Semiconductors have been on a tear recently, and just this week the performance difference between SOXL and DRN was 11%! We can’t know ahead of time which sectors will definitely outperform over the next week, month, quarter, or year. But the ETF Sector Plus Strategy gives us an edge—not 100% accuracy, but a high probability of being right.

For the model, we are now in Semiconductors, Healthcare, and Technology.

Here is a summary of the weekly performance of all the ETFs that the strategy monitors:

Best wishes for your trading,

James Kimball

Trader & Analyst

MarketGauge