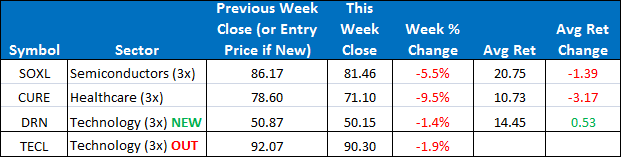

This week we issued one change in the model. On Monday morning, we sold out of TECL and bought DRN at the open. To open next week, we will be in SOXL, CURE, and DRN but changes in our portfolio could be afoot.

The SPY closed the week down -2.6%. The ETF model was down -6.1% for the week. It was a vicious week for the markets in general with the Nasdaq having the worst down day in three years. The Nasdaq is now down -4.3% for the year. The model, being still concentrated in SOXL and CURE took it on the chin as the high beta names sold off the hardest. The ETF Sector Plus Strategy is still up +6.05% year-to-date compared to its benchmark, the SPY, which is now down -1.7%.

This Week’s Strategy Lesson: Model Said There’d Be Weeks Like This

This was a rough week for the ETF Sector Plus model. It was a rough week for the markets in general. The SPY and the DIA took out the 50 day moving average and the IWM made it all the way to the 200 day moving average with the QQQ trying its hardest to follow suit. The selling pressure was the greatest in some of the high beta technology and biotechnology names that have been market leaders for quite some time.

The ETF Sector Plus Model took its fair share of punishment from the downdrafts in the market. We had already lowered our beta exposure by transitioning into DRN, but SOXL (semiconductors) and CURE (healthcare) had severe selloffs in the later half of the week.

Overall, the model was down 6.1% for the week, giving up about half of the gains for the year but still leaving us up 6% for the year and outperforming the SPY by almost 8%.

Some of the wild swings from holding leveraged ETFs should be ignored. They represent “noise” --the volatility of the instruments as they head up or down on their way. But were the wild swings this week more than just noise?

The reasons for the selloff were myriad--a cocktail of global tensions over Ukraine, concern about FED policy becoming ineffectual, corporate earnings coming in light, and insiders and funds aggressively selling stocks that have outrun their valuations.

While we might not have all the ingredients in place for a recession, by most calculations we are long overdue for a market correction. Could this be the start of a serious correction or just another one of the numerous minor corrections we saw sprinkled throughout the bull run of 2013? Time will tell.

For the model, we will continue to hold SOXL, CURE, and DRN. It is worth noting that we have had some shakeups in the top of our rankings and could very well see some significant changes to our holdings next week. TMF (treasuries) is now ranked 3rd and ERX (energy) is ranked 4th. The market action on Monday could determine a change out of CURE into one of those two ETFs. Stay tuned to the daily updates for any changes.

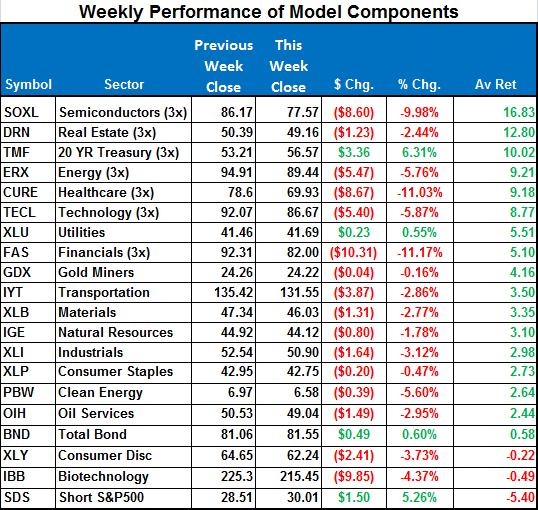

Here is a summary of the weekly performance of all the ETFs that the strategy monitors:

Best wishes for your trading,

James Kimball

Trader & Analyst

MarketGauge