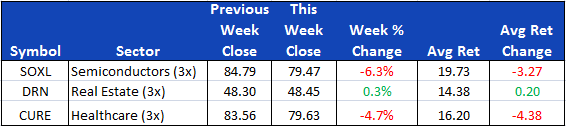

This week there were no position changes in the strategy. The top three sectors remain Semiconductors, Healthcare, and Real Estate.

The SPY spent another week churning, this time taking a small plunge on Thursday and Friday to end the week down -1.9%. The ETF model was down -3.5% for the week with DRN hedging out some of the losses in SOXL and CURE. The ETF Sector Plus Strategy is up nearly +9% year-to-date compared to the SPY which is flat at +.4%.

This Week’s Strategy Lesson: Spinning Tops

In Japanese candlestick charting, a spinning top pattern is when a candlestick has a short body with long wicks above and below it. It is typically associated with an indecisive market. A situation where the buyers and sellers arrested and surrendered control throughout the day but at the closing bell, the referee ruled the fight an “indecision.”

These can be especially difficult days to daytrade as there is little follow-thru from breakouts. And for position trading, when they occur in potential key inflection areas on charts, they can signal an end to a trend, or at least a momentary cease-fire in the market’s movement.

The unrest in the Ukraine and the potential for Russian involvement in Crimea and beyond has been a catalyst for the indecision in the markets the last few weeks. Most of the major up days can be attributed to positive news on that front and most of the down days were the result of military drills near the borders or saber rattling by political leaders.

We also had some troubling numbers come out of China last weekend. Once they were adjusted for seasonal effects, like the timing of the Lunar New Year, they didn’t look as bad, but it still sent Chinese equities down and put further asterisks next to the worldwide growth projections for the year.

The end result of these disturbances left the SPY closing nearly flat from its moves over the last three weeks while we saw seven or eight “spinning top” days in last 15 or so trading days. The market is clearly in turmoil as it digests the news.

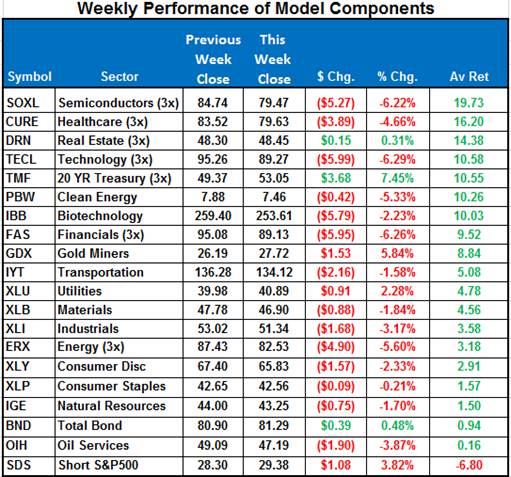

Stay tuned to our daily position updates emails. If the market takes a turn for the worse, we might just have a position change into a more defensively oriented ETF. TMF, the 20yr treasury ETF, might be a likely candidate as it has been climbing steadily in the rankings currently sitting tied with TECL for 4th/5th place.

Here is a summary of the weekly performance of all the ETFs that the strategy monitors:

Best wishes for your trading,

James Kimball

Trader & Analyst

MarketGauge