Extraordinary Recent Performance

This week there were no position changes in the strategy. We continue to hold TECL, SOXL, and CURE. Technology, Semiconductors, and Healthcare continue to be the three leading sectors.

The SPY took a big hit heading into February, but has since made a tremendous recovery from the February 3rd lows. The SPY was up +2.4% this week, while the ETF Sector Plus Strategy holdings were up an average +10.9%.

As we discussed in the first monthly training webinar, the ETF strategy is designed to help us catch the major trends that occur during a liquidity cycle. These trends usually have a fundamental basis of improving technology or prospects for the sector in question. That is what gives these trends persistence. In this strategy, we are taking strategic, concentrated and leveraged bets that these strongest sectors of the market will continue to lead.

The strategy's "concentration" comes from limiting our holdings to 3 positions, and the "leverage" is because often one or more of our positions are in triple leveraged ETFs (we'll explain more about these in future webinars and emails). This combination of concentration and leverage propels the strategy to some tremendous returns.

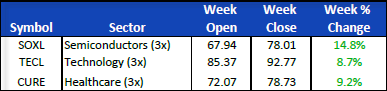

Right now our positions are all in triple leveraged and all three are leading the market to new highs. As a result, the recent returns have been extraordinary as you can see when you compare this week's +2.4% gain to our strategy positions below.

Weekly Performance for Positions

This Week's Strategy Lesson

This week I wanted to talk a little about the volatility inherent in the ETF Sector Plus Strategy. While the strategy has outperformed the market wildly the past several years, one cost of that out performance is an added dose of volatility.

The strategy's volatility can be compared to what you might expect with a hot stock like NFLX or TSLA, except that with the ETFs that we hold in the strategy we avoid nearly all of the earnings or news risk that can permanently break a stock.

The graphs below show some of the weekly and monthly variance between the ETF Sector Plus Strategies performance and those of its benchmark, the SPY. Often we can be up or down 3 or 4 times as much as the SPY in a given period.

One of the best ways to learn to trade a volatile system (or any volatile financial instrument for that matter) is to start small. This cannot be overemphasized. We believe strongly in the edge that this strategy gives us as traders. But that edge isn't very useful if we get easily shaken out of a trade.

From the charts below, you can see what type of volatility you might expect and be prepared to position size so that you can handle these types of equity swings.

Due to this volatility, we suggest starting with about a third of the money you might want to initially invest in the strategy. You should still be in all three ETFs, but you will have less overall exposure. Over time you can then "scale" into a larger position by adding in 1/3 increments.You can read more about “scaling in” in the FAQ, and How To Use The Model sections of the member area.

Weekly Performance Summary

Here is a summary of the weekly performance of all the ETFs that the strategy monitors: