January 7, 2026

Uncategorized

By Lincoln Oehlers

Data as of: December 9, 2025

EPS Due: 12/11

Avg. True Range (ATR): $7.56

Last Price: 195.47 +2.15 +1.97% %Vol: +37%

MarketGauge Technical Rating |

|

| Short-Term (1–5 days) |

★★★★★ |

| Intermediate (1–6 weeks) |

★★★★★ |

| Long-Term (2–6+ months) |

★★★★★ |

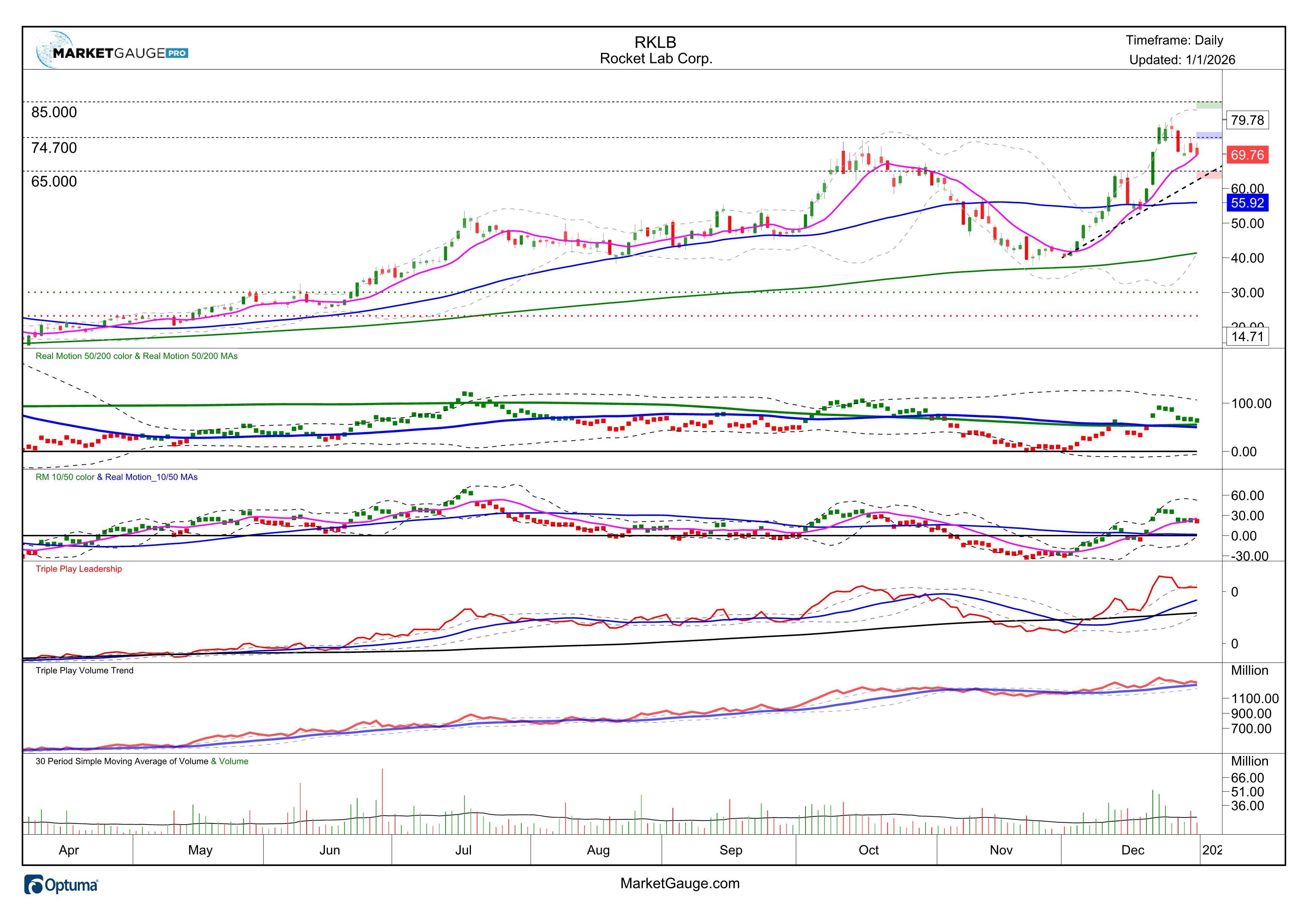

Current Position: Long Entered on 2025-12-29 and $74.75

Trading Ideas & Actionable Price Zones:

Trade Time Frame: Intermediate (1-6 weeks)

Inflection Point: $74.69

Flag breakout on the 10-DMA. Initial buy over 12/30 high

Inflection Point: $65.18

Key support under the 10-DMA is the 12/12 swing high at 65. This is a wide stop for sizing up a potential trade before the low of the flag has been determined.

This 2 ATR target is equal to the risk, and it would exceed the 79.78 high by enough to assume a no-loss stop should not get hit.

Trade Notes:

** For more specific trading tactics for entering, exiting, and taking profits, attend the live mentoring or review the recordings **