January 5, 2015

Weekly Market Outlook

By Keith Schneider

The final tallies are in for 2014 and on the global financial scoreboard, the US has scored a knock-out in virtually all asset classes. It doesn’t get better than this. US Bonds, Stocks, and currency are all at or near all-time or multi year’s highs. Corporate profits and margins are robust, the GDP annual growth rate based on the last quarter was 5% and unemployment is way down from the depths of the financial crises. Compare this to Russia, led by Putin, where the ruble is in ruins, the Russian stock market is in the tank, short term rates hit 17%, and the contrast is startling. But on the bright side, he does now own Crimea, cheap oil and gold. Despite it all, Putin gets high marks from Russian voters and his popularity still sits near all- time highs. He has also just won the award by being named “Person of the Year” by the Sarajevo based OCCRP (Organized Crime and Corruption Reporting Project). He was recognized for turning Russia into a major money laundering center. Perhaps Obama needs to borrow from Putin’s playbook by invading a country or two, tanking the economy, jacking up rates and squashing the press to improve his ratings.

The final tallies are in for 2014 and on the global financial scoreboard, the US has scored a knock-out in virtually all asset classes. It doesn’t get better than this. US Bonds, Stocks, and currency are all at or near all-time or multi year’s highs. Corporate profits and margins are robust, the GDP annual growth rate based on the last quarter was 5% and unemployment is way down from the depths of the financial crises. Compare this to Russia, led by Putin, where the ruble is in ruins, the Russian stock market is in the tank, short term rates hit 17%, and the contrast is startling. But on the bright side, he does now own Crimea, cheap oil and gold. Despite it all, Putin gets high marks from Russian voters and his popularity still sits near all- time highs. He has also just won the award by being named “Person of the Year” by the Sarajevo based OCCRP (Organized Crime and Corruption Reporting Project). He was recognized for turning Russia into a major money laundering center. Perhaps Obama needs to borrow from Putin’s playbook by invading a country or two, tanking the economy, jacking up rates and squashing the press to improve his ratings.

The market finished the year positive for US Stock indexes with the S& P 500 up a respectable 12-13%. IWM ( Russell 2000), our biggest concern this year as it was the worst performing US Stock Index that represents smaller to mid-caps, actually finished out the year marginally up ( +2%), by knocking out a 12 inning, game winning home run. On December 16, the IWM closing price was showing losses of about -2% on the year, but staged a nice comeback by closing near its highs by year-end and closing out 2014 slightly positive.

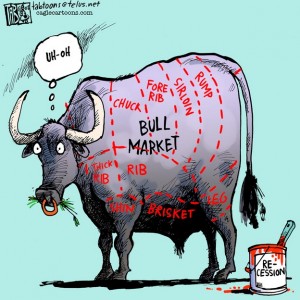

However, on closer inspection, short term market action shows signs of a potential bull trap on several market indexes. First, on the last day of 2014, US equities markets closed down 1%, followed by another weak close on the first trading day of this year, unable to hold a decent opening pop. The leading index, the NASDQ 100 (QQQ), has been unable to match its highs put in earlier last year which could be another indicator pointing to a tired bull.

American investors, generally are (at least around the end of year) an optimistic bunch and see the glass as half full, so this size decline on the final day of the year is an anomaly. It has only occurred 4 times in the past 100 years. The initial opening run up on the first trading day of the year ended up in smoke, however penny pot stocks rallied. Hmmm... So the question lingers, does the price action in this old bull indicate that he has just ate his last supper or is he resting up for his next charge?

Every week you'll gain actionable insight with: