Bull Markets Are Complicated

(Until You Keep It Simple)

If you’re following the play-by-play news headlines as they relate to the stock market you’ve had a lot to digest in the last week and a half.

With only two days left in the 3rd quarter it appears that the bulls will deliver another strong quarterly report card despite some ominous headlines like more 100% tariff announcements and a government shutdown all but scheduled for October first.

Why isn’t this market selling off? Or did the sell off just begin.

In the upcoming week the markets will:

- Close the 3rd quarter

- Face the Sept. 30th deadline to fund the government

- Get the monthly non-farm payrolls and unemployment report.

It could be a very interesting week ahead.

Here’s what investors should focus on with respect to how the market has been acting leading up to the upcoming week.

On the 17th, Fed Chair Powell handed the market what he described as an “insurance rate cut” and the stock market thanked him by rallying to new highs. The long bonds, however, peaked and have sold off since.

Last Tuesday, Chair Powell tempered the market’s enthusiasm by describing stocks as “fairly highly valued” which sent the Magnificent 7 stocks sliding, and a large part of the market followed.

On Thursday GDP and labor market data suggested enough economic strength for this “good news to be bad news” for stocks as they continued to slide lower for a third straight day.

On Friday, the Fed’s favorite inflation measures in the PCE data were reported to be in line with expectations, and stocks breathed a sigh of relief and closed modestly higher.

It seems unlikely that neither a government shutdown nor the labor report will turn last week’s market retreat into a major correction, but either could cause some more short-term volatility.

The bigger threat to or fuel for the bull market comes later in October.

**The rest of the commentary will be posted later this evening

|

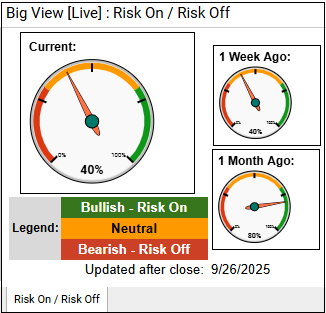

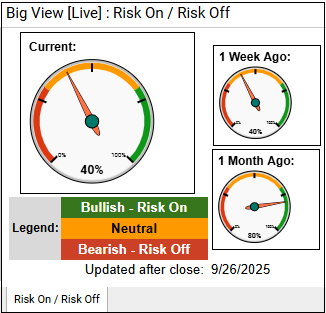

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts. Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral.

The video analysis dives deeper. |

Summary: Markets staged a pullback, keeping the broader bull trend intact across U.S., value, growth, and global equities, with semiconductors showing leadership. However, weak volume, deteriorating new high/low ratios, and strength in gold highlight underlying fragility, leaving the risk gauge neutral despite the positive rebound.

Risk On

- Markets put in a healthy minor correction and a nice recovery on Friday. If we can hold the lows of this week, the bull market should remain strongly intact. (+)

- With the rally on Friday, sentiment readings are very low, reflecting lack of concern over the minor weakness in markets this week. It could also mean complacency (+)

- Both value and growth are in bull phases although value on short-term basis is outperforming the S&P benchmark. (+)

- The Economic Modern Family is all in bull phases with Semiconductors leading. (+)

- Both emerging and developed markets are in bull phases. Established foreign equities need to hold their 50-Day Moving Average, currently around $91, to maintain a bull phase and could be a potential lead indicator for all equities if it fails. (+)

- Unless we have a significant move lower in the next few trading days, markets have bucked their weak September seasonal trend and October tends to be a weak positive month. (+)

Neutral

- A majority of sectors were down on the week with energy, utilities, and gold miners up. However, the semiconductors were quite strong. (=)

- Market internals have bounced off their modestly oversold levels from earlier this week. Up down volume has moved backed to neutral. (=)

- The Risk gauge remained a weak neutral. (=)

- Soft commodities looking to move back into a bull phase. (=)

Risk Off

- Volume patterns remain weak with 3 of the 4 indexes showing significantly more distribution days than accumulation. (-)

- Metals and energy were the strongest performers this week. Regional banks and homebuilders were among the weakest. (-)

- The new high / new low ratio is rolling over with stacked and sloped negative readings. (-)

- The color charts (moving average of stocks above key moving averages) on a short and intermediate term basis for, the S&P500 is negative, while the longer-term timeframe remains a bit more positive,and the Nasdaq is either negative or neutral in all timeframes (-)

- Gold closed on all-time highs. Countries are increasing their gold reserves. (-)

Market Context

- Overall: Bull market remains intact despite a minor correction, supported by Friday’s rally.

- Leadership: Semiconductors, value equities, and emerging markets are leading; gold strength signals defensive hedging.

- Risks: Weak volume, rolling new high/low ratios, and sector divergences (regional banks, homebuilders weak).

- Seasonality: September weakness appears behind us; October historically modestly positive.

Actionable Trading Plan

- Equity Exposure (Core Trend)

-

- Action: Maintain long exposure to SPY/QQQ/IWM but keep stops just below this week’s lows.

- Rationale: Holding the weekly lows confirms the bull phase; a break would indicate deeper correction risk.

- Sector/Group Rotation

-

- Overweight:

- Semiconductors (SMH, SOXX): Add exposure on pullbacks near the 50-Day MA; target +5–8% upside.

- Value ETFs (VTV, DVY): Short-term outperformance vs. S&P suggests relative strength continuation.

- Emerging Markets (EEM, VWO): Buy dips above the 50-Day; use as a lead indicator for global equity tone.

- Underweight:

- Homebuilders (XHB) due to structural weakness and a potential breakdown under the 50-Day Moving Average.

- Commodities & Precious Metals

-

- Gold (GLD): Strength and central bank buying support continued upside. Initiate or maintain partial hedge allocation; stop ~3-5% below all-time highs or last week’s low.

- Energy (XLE, USO): Keep modest exposure as energy remains resilient.

- Risk Management

-

- Stops & Risk Control:

- Tighten stops below weekly lows on index ETFs.

- Neutral Readings: With risk gauge weak neutral, avoid over-leveraging; keep 15–20% cash buffer for tactical adds.

- Tactical Opportunities

-

- Soft Commodities (DBA, sugar, coffee ETFs): Watch for breakouts into bull phase; initiate small starter positions if trend confirms.

- Seasonality: Historically, October tends to be modestly positive—assuming its not 1929 or 1987 or 2008 –look to add exposure on early month weakness.

✅ Summary Trade Ideas:

- Long SMH

- Long EEM

- Hedge with partial GLD allocation

- Maintain SPY core

Stay One Step Ahead of The Markets and Profit

From The Current Volatility With Market Outlook

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.