November 4, 2012

Weekly Market Outlook

By Geoff Bysshe

Thanks to a great job by President Obama, FEMA, various state, city officials, local fire and police departments, Hurricane Sandy’s impact was blunted, but not thwarted.

Thanks to a great job by President Obama, FEMA, various state, city officials, local fire and police departments, Hurricane Sandy’s impact was blunted, but not thwarted.

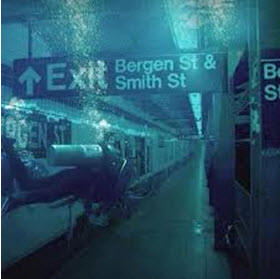

Considering Hurricane Irene last year, Sandy this year, and the chance of yet another monster storm this winter, the whole infrastructure of New York City and the northeast needs to be reconfigured, either that or distribute scuba gear for all New Yorkers who live in low rises or below 14 Street. Clearly, these storms are not just random events and some serious central planning needs to happen.

There was a period of time where similar thinking was pervasive on Wall Street where markets were considered random and Black Swan events not built into models because they won’t happen in one’s trading lifetime. One thing is certain, denying those facts can destroy decades of hard work in very short order.

While on the topic climate change, the markets are undergoing their very own. This past Friday, Gold tanked $40 oz. and is off $120 from recent highs made less than a month ago, currently trading at $1675. A nice 1.5 % pop on Thursday in key US Stock Indexes also fizzled out, with the market giving it all back by Fridays close. In the current climate one would have expected a huge move up in bonds as well, but good economic news mitigates the need for more easing. We got that with a good jobs number. So, the climate of lousy news and higher prices for stocks, bonds and gold, might be ripe for a change. Also noteworthy is Japan’s economic decline whose central bank announced another round of easing, putting pressure on an extremely overvalued Yen. This week’s video covers all this and more.

Have a great Weekend

Every week you'll gain actionable insight with: