Dangerous Warning Signs, or Healthy Rotation?

Friday’s stock market locked in gains and/or continued a bearish rotation pattern (depending on your point of view).

There was something for all the bears to support their view. The top 20 declining stocks in the S&P 500 suggested bearish tariff effects, AI weakness, and weakening consumer demand.

However, the bulls didn't relent; they pivoted.

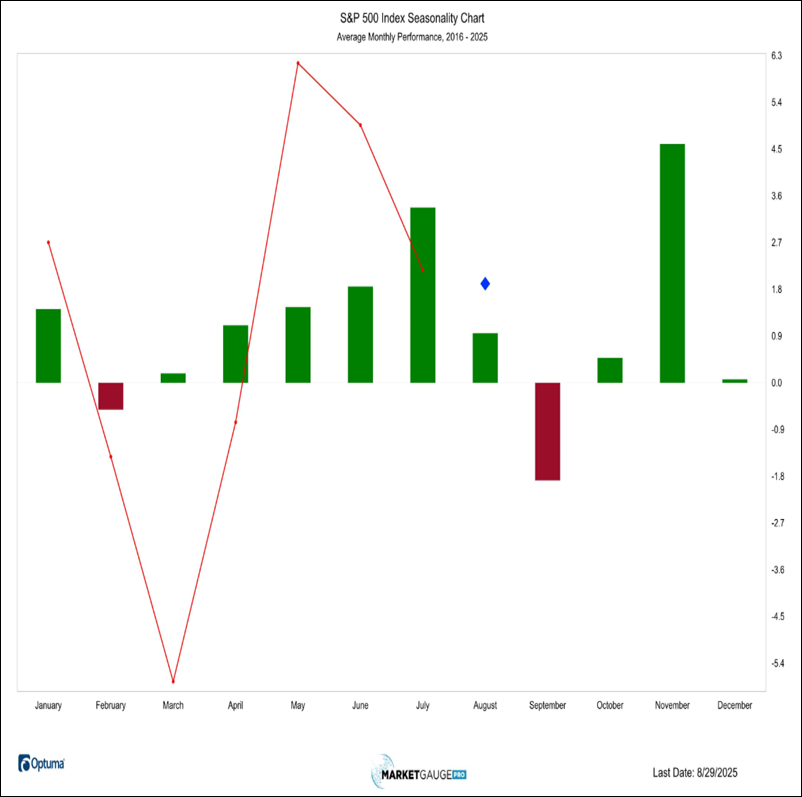

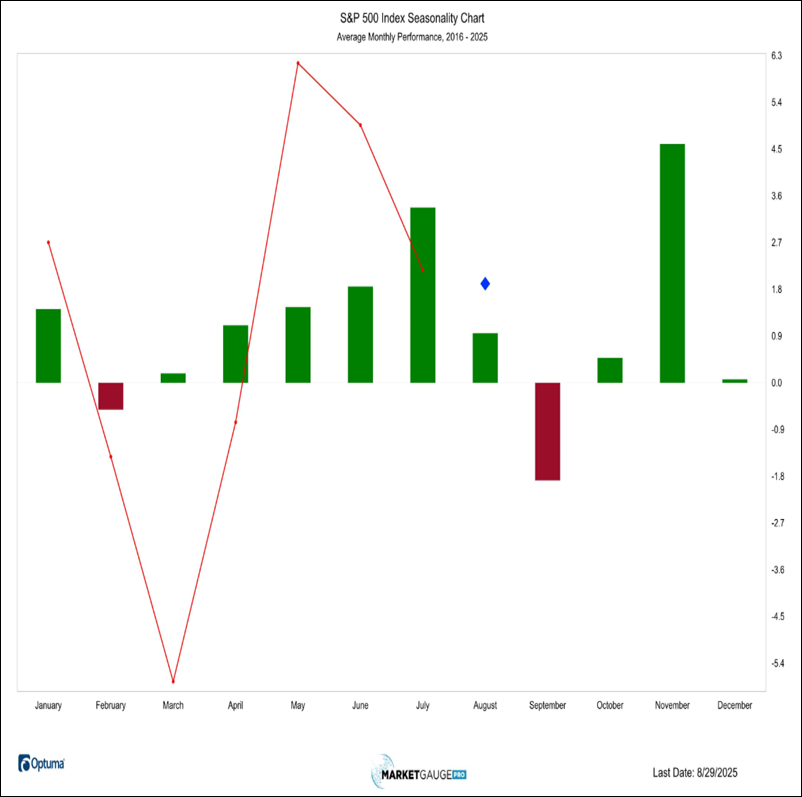

Regardless, it certainly felt ominous for any bull, who knows the bearish reputation of September, which is justified by the chart below.

Nasdaq was particularly weak as the bullish leading sector theme continued to falter. Fortunately, a less admired sector continued to try to provide leadership as it closed at new all-time highs.

September has one of the worst track records for the equity index, but not all sectors are equally bearish. Additionally, the entire month is not equally bearish. Finally, not all Septembers are bearish.

This week’s Market Outlook commentary will dive into the details of what led the market’s decline yesterday, what Friday meant for the otherwise bullish month of August, and what August’s price action may suggest about what’s to come in September.

Plus, with the most popular refrain on the Street being “September is a bearish month so we expect volatility”, we’ll look into exactly what “September is a bearish month” really means (i.e. what part of the month, which sectors, how often and how bearish in good times and bad).

We’ll also reveal that the same cohort of investors that anticipated the bearish correction earlier this year is not as bearish right now.

As always, we’ll also suggest a simple way to stay bullish (since that’s the prevailing trend) until the bears start winning (assuming they don’t get hoodwinked again).

This week's commentary was delivered as part of our live mentoring on Tuesday (markets were closed Monday). Here is the excerpt from that mentoring session:

|

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts. Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral.

The video analysis dives deeper. |

Summary: Markets remain broadly risk-on with major indexes near all-time highs, strong new high/new low ratios, and all key sectors of the “Economic Modern Family” in bull phases, though QQQ needs to hold its 50-Day and semiconductors remain a key to watch. However, mixed volume, gold’s breakout, weakness in Bitcoin, and the start of September seasonality add cautionary risk-off signals.

Risk On

- Markets took a breather near or at new all-time highs in the S&P, though they sold off a bit on Friday on a hotter than expected inflation report. Its important to watch the QQQs to hold above their 50-Day or swing low from the middle of August as momentum is failing on this leading index. (+)

- New high new low ratio surged higher and is positively stacked and sloped. (+)

- Risk gauges remain strongly risk-on, though it did deteriorate slightly due to the strength in Gold. (+)

- On a short-term basis, value seems to be holding up a bit better, but they are both in bullish phases and as long as one of them doesn’t dip into a warning phase its still risk on. (+)

- All six members fo the Economic Modern Family are in a bull phase. We are watching semiconductors closely to hold the 280 level and its 50-Day Moving Average. (+)

- Both emerging and more established foreign equities remain in a bull phase. If they can maintain their bull phases, the global equity market rally should continue. (+)

Neutral

- Volume patterns improved a bit from last week, but still mixed overall with about the same number of accumulation days as distribution over the last two weeks. (=)

- Market internals came off a little from last weeks highs/breakouts, though they are still broadly neutral to positive. (=)

- The color charts (moving average of stocks above key moving averages is positive across all-time frames for the IWM, mostly positive on the SPY, and skewing neutral on the QQQ. (=)

- Aggs continues their bullish action, closing at some of its highest levels since March, indicating some inflationary pressures. At best, its neutral for the market. (=)

- Yield curve steepened slightly. (=)

- Sentiment readings perked up slightly into Friday’s sell-off, but remains near its lowest levels in a bear phase, however the ratio of one month volatility verses 3 month crossed its moving average from very overbought levels which could be viewed as risk off (=)

Risk Off

- Risk-off sectors like gold miners, energy, and materials up, while semiconductors, biotech, and retail were down, more of a risk-off skew. (-)

- Gold finally broke out of its months-long trading range, breaking out to new all-time highs on an intra-day and closing basis, outperforming the S&P over the last couple weeks. (-)

- Bitcoin is looking a little shaky, after taking out its all-time high, its sold off below it’s 50-Day Moving Average and closed on its recent lows on Friday. (-)

- Markets are entering one of the worst seasonal periods in September. (-)

For Actionable Trading Guidance:

1. Equities – Stay Long, Monitor Key Levels

- Bias: Maintain core long exposure to equities, as broad indexes (S&P, IWM, DIA) remain in bull phases and risk gauges are mostly risk-on.

- Action:

- Hold positions in leading sectors (semiconductors, retail, transports, biotech) but watch QQQ at its 50-Day and semiconductors at 280 as key support levels. If those levels break, trim exposure.

- Consider adding to value-oriented ETFs (e.g., VTV, IWD) given short-term relative strength.

2. Risk-On Expansion – Emerging/Foreign Equities

- Bias: Global rally intact as both emerging and developed foreign markets remain in bull phases.

- Action: Initiate or add to positions in EEM, VWO, or country-specific ETFs showing relative strength.

- Stop: Tighten stops just below 50-Day MAs to avoid drawdowns if risk-off accelerates.

3. Risk-Off Hedges

- Gold & Commodities: Gold’s breakout to all-time highs is a risk-off warning.

- Action: Add a partial gold hedge (GLD, GDX) to balance equity exposure, but size modestly (5–10%) given inflation link.

- Bitcoin: Technical breakdown under the 50-Day is bearish.

- Action: Avoid new longs; short-term traders could consider a tactical short/hedge below recent lows with stops just above the 50-Day.

4. Seasonality & Volatility

- September Seasonality: Historically weak month for equities.

- Action: Reduce leverage, take partial profits into strength, and be prepared to rotate quickly if breakdowns confirm.

- Volatility: Still near lows, providing favorable entry for hedging.

- Action: Consider buying protective puts on QQQ or SPY while volatility premiums remain relatively cheap.

5. Risk Management

- Stops: Place stops under key index levels (QQQ 50-Day, SPY August swing lows, SMH 280).

- Position Sizing: Keep equity allocation overweight but layer in 10–20% defensive hedges (gold, volatility, cash) to account for seasonality and risk-off signals.

- Review Weekly: Reassess if risk gauges shift, particularly if more sectors dip into warning phases.

Stay One Step Ahead of The Markets and Profit

From The Current Volatility With Market Outlook

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.