December 28, 2014

Weekly Market Outlook

By Keith Schneider

Last week we highlighted how Putin might maneuver on the global chessboard and cozy up to Turkey to prop up the failing Russian economy and check the west. He made some key moves this week, cancelling a strategic pipeline project with the west while offering his claw of friendship to Turkey. Putin’s gambit included a new pipeline deal along with cheap energy to Recep Tayyip Erdogan, the embattled President of Turkey. If Erdogan goes for it Turkey will be 75% dependent on Russian energy and no longer be considered a reliable NATO partner.

Last week we highlighted how Putin might maneuver on the global chessboard and cozy up to Turkey to prop up the failing Russian economy and check the west. He made some key moves this week, cancelling a strategic pipeline project with the west while offering his claw of friendship to Turkey. Putin’s gambit included a new pipeline deal along with cheap energy to Recep Tayyip Erdogan, the embattled President of Turkey. If Erdogan goes for it Turkey will be 75% dependent on Russian energy and no longer be considered a reliable NATO partner.

The situation is fairly bleak for Russia as its economy has been contracting at a rate of -4.5% compared to +5.0 growth here in the United States. Russians that have a memory of the old USSR or its last default have begun hoarding basic commodities as its currency collapses and inflation spirals out of control.

In a weaker move Putin threatened to cut back oil production and then also chimed in on the current rowe with North Korea over the “The Interview “. This is not likely to stem the tide on sinking oil prices or instill confidence to stop the outpouring of western capital from Russian markets. The fear of open media is not without cause as Putin witnessed the rather quick demise of the old USSR once iron fisted censorship was lifted and the causes of the Chernobyl nuclear meltdown revealed. He sort of understands how Kim might feel if the “The Interview” leaks into the North Korean psyche. From our western vantage point lampooning our leaders is a fine art, not life threatening. In the age of instant communication, even the slightest ember of discontent can ignite into revolution in closed societies.

Turkey has been going thru a bit a crisis itself as it has cracked down on freedom of the press. It has imprisoned dissident journalists and crushed street protests with an overwhelming presence of police in riot gear. Turkey, a critical NATO ally under a democratically elected moderate Islamic party is having an identity crises. Can even a moderate Islamic ideology tolerate open society, freedom of speech and equality for all?

The same theme resonates, open society is good for business but it has blowback if you are a Dictator or run a Kleptocracy. It’s also hard to straddle old ideologies with an open society that is good business and with high standards of living. Erdogan chided contemporary women for not wanting to stay home and raise children, landing him in the women’s rights doghouse.

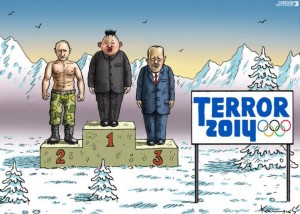

Erdogan’s Turkey, Putin’s Russia and Kim’s North Korea all make strange bedfellows, but they all have quite a bit in common…. A disdain for some basic freedoms.

As 2014 comes to a close, only the US, India and China have positive TSI (Market Gauges proprietary Trend Strength Indicator) for their respective stock markets. Tracking the energy market and Global- Politics will be more important than usual for navigating the markets in 2015. Anything can happen, including a change in stance by OPEC, unexpected military action by a country dependent on oil exports or even a greater collapse in energy prices.

At this point, cheap energy has yet to be fully absorbed by consumers and it will be a big net positive to the global economy. If the drop in energy prices persist, it will be one of the greater transfers of wealth in recent history. It will continue to have negative impact on Russia and the twelve OPEC countries that produce almost 60 % of the world’s oil supply. They depend on those revenues to sustain their economies. Junk debt related to oil exploration will be under pressure as well.

Meanwhile, the US continues its dominance as a super-power with a trifecta that includes an economy growing the fastest in 11 years, along with a soaring currency, stock and bond markets. How long will the fed be able to keep rates low with a surging economy and an already strong dollar is the wildcard for this long running bull market.

Happy Holidays and Happy New Year from Keith Schneider and the MarketGauge Team

Let’s go to this week’s video and look at the usual fare and some energy related items as well...

Every week you'll gain actionable insight with: