June 10, 2012

Weekly Market Outlook

By Keith Schneider

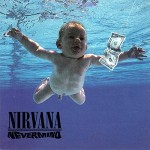

After the worst monthly performance in recent memory and a rocky start to June, the markets said never mind to those who were looking for a meltdown. Out came the baby bulls, finding Nirvana with a monster rally up over 4% for the week and closing on the highs. The classic pattern of sell offs on high volume and rallies on light volume continue to be of concern looking further out.

After the worst monthly performance in recent memory and a rocky start to June, the markets said never mind to those who were looking for a meltdown. Out came the baby bulls, finding Nirvana with a monster rally up over 4% for the week and closing on the highs. The classic pattern of sell offs on high volume and rallies on light volume continue to be of concern looking further out.

In this market, Nirvana comes to those willing to take profits quick on short term tactical trades otherwise, like the babe in the picture above, profits will be just out of reach.

Federal Reserve chief Bernanke came equipped to a congressional meeting Thursday with a few economic reports showing that things are not bad enough to turn on the monetary spigot and squashed Thursday’s large gap up. However, Obama spoke on Friday, mentioned strong job growth in the private sector and brought some life back into the market, closing on the highs for week.

So here we sit back, into a strong warning phase but with the market internals getting closer to overbought, but not quite there. This week’s video is going to cover some surprising strength in a market sector that has been out of favor since 2007 as well our usual coverage...

Also, be sure to subscribe to our YouTube channel here and get all of our free videos as soon as they’re released!

Every week you'll gain actionable insight with: