September 22, 2013

Weekly Market Outlook

By Keith Schneider

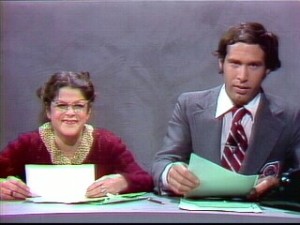

The message by the close of the US Markets this Friday afternoon was "Never Mind". Forget the easy money policies of the Fed, forget Obama-care, and say hello to debt ceiling issues once again. Say hello to dysfunctional Capitol Hill, which seems always to act as picadors for wild bulls. Those of us who are young enough to remember Emily Latella, who usually got it wrong, the Market certainly mimicked her antics by closing under where it started before the Fed announced its plans to keep the spigot wide open. However, in all fairness to Mr. Market, new rumblings from the Fed indicated that the decision not to taper was marginal. The stay of execution might only be till October which is hardly enough to write home about and a "Never Mind" from the Fed itself. The last time the debt ceiling limit was reached and Congress played chicken with raising it, it cost US taxpayers about $20 billion, which caused the stock market to drop about 5.6% in a single day when Standard and Poor's lowered our credit rating. It all turned into a great buying opportunity, but we might not get so lucky again.

The message by the close of the US Markets this Friday afternoon was "Never Mind". Forget the easy money policies of the Fed, forget Obama-care, and say hello to debt ceiling issues once again. Say hello to dysfunctional Capitol Hill, which seems always to act as picadors for wild bulls. Those of us who are young enough to remember Emily Latella, who usually got it wrong, the Market certainly mimicked her antics by closing under where it started before the Fed announced its plans to keep the spigot wide open. However, in all fairness to Mr. Market, new rumblings from the Fed indicated that the decision not to taper was marginal. The stay of execution might only be till October which is hardly enough to write home about and a "Never Mind" from the Fed itself. The last time the debt ceiling limit was reached and Congress played chicken with raising it, it cost US taxpayers about $20 billion, which caused the stock market to drop about 5.6% in a single day when Standard and Poor's lowered our credit rating. It all turned into a great buying opportunity, but we might not get so lucky again.

The short term technical picture for the markets is negative with the last three day of action indicating a potential short term blow off top, while the longer term trend remains intact for equities. Stock Market valuations according to Icahn and Buffet are high.

Rates dropped marginally on Friday, with bonds rallying but they seem undecided on whether or not the potential double bottom in Bond prices remains intact or that the decade's long rally is finally over and the Fat Lady is singing.

Critical Chart points across all key asset classes will be covered in this week's video.

Every week you'll gain actionable insight with: