May 28, 2012

Weekly Market Outlook

By Keith Schneider

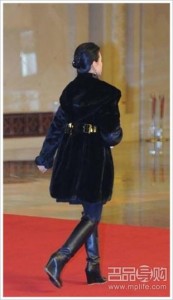

The photo to the right is not a picture of a Chinese fashion event but that of an elite communist party member making her entrance to a Congressional meeting. This getup included a fur coat and Chanel boots. Personally, I love the look from a fashion perspective but it’s not up to snuff on the ideological front. This week it was reported that the top 70 communist party leaders had an average personal net worth of 1.5 billion dollars each.

The photo to the right is not a picture of a Chinese fashion event but that of an elite communist party member making her entrance to a Congressional meeting. This getup included a fur coat and Chanel boots. Personally, I love the look from a fashion perspective but it’s not up to snuff on the ideological front. This week it was reported that the top 70 communist party leaders had an average personal net worth of 1.5 billion dollars each.

Considering that the average Chinese worker makes about .57 cents per hour or $1200 US per year, one might conclude the trickle down effect is working a tad better here in the US. It's no wonder that those in charge keep a tight lid on use of the internet.

The future of the Global Economy is substantially hinged on China's ability to balance the need to cool an overheated economy fueled by corruption while keeping the masses hopeful. In a world of instant communications enabled by social media, Chinese Communist tycoons, Russian Oligarchs with 500 foot yachts, Arab Dictators, and Oil Sheiks are a threatened species. While I am on this rant, extreme greed here in the US should be placed on the threatened species list as well.

Look no further than the Facebook IPO where greed trickled down from Facebook founders and early investors, to the bankers underwriting this turd. Not only did they over hype to miss-price, hide critical financial projections from the public, but the underwriters selectively allowed certain clients to short, further hammering the stock. One thing though, at least Facebook created something of value and its pity that its reputation will be forever besmirched. For now the message is "Party On" but "Party Over" could come sooner than expected.

Getting back to equity markets, it's of no surprise that they struggled to stabilize last week after its nasty sell off this month caused by weak economic reports, chronic Eurozone issues, expanding losses at JPMorgan, a looming fiscal crises and the Facebook fowl-up. The market's warning phase has continued to accelerate but downside momentum has stalled. To see what might be in store this week let's go to the video...

Also, be sure to subscribe to our YouTube channel here and get all of our free videos as soon as they’re released!

Every week you'll gain actionable insight with: