October 20, 2013

Weekly Market Outlook

By Keith Schneider

This week, The US equities market had one of its best performances in recent memory making new highs, never believing for more than a few moments that a debt default was in the cards. It loves the cocktail of no tapering, a rapidly depreciating dollar, and record prices for tech. Google, Cloud Computing, Social Media and even solar plays are leading the charge, and at least in Google's case are actually grounded in solid growth. On a more cautious note, some Cloud Computing valuations are at multiples of sales (not earnings) last seen in 1999.

This week, The US equities market had one of its best performances in recent memory making new highs, never believing for more than a few moments that a debt default was in the cards. It loves the cocktail of no tapering, a rapidly depreciating dollar, and record prices for tech. Google, Cloud Computing, Social Media and even solar plays are leading the charge, and at least in Google's case are actually grounded in solid growth. On a more cautious note, some Cloud Computing valuations are at multiples of sales (not earnings) last seen in 1999.

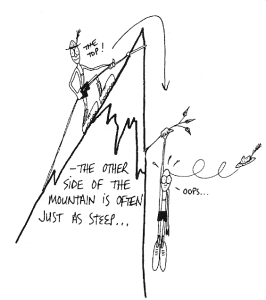

Meanwhile, the balance sheet of the Fed continues in its parabolic mode with no end in sight. The players on Capitol Hill have given their portfolios yet another gift by assuring the markets there is still another wall of worry to drive markets higher, as the debt ceiling still needs to addressed in just a few short months, reducing the chances of a taper. Reminiscing markets past, having experiencing them up close, starting with the Hunt brother's cornering of the silver market, parabolic moves go much faster and even farther than anyone expects. They then can drop with equal force. The fuel back in 1980 was the Hunt's billions and OPEC's tripling of the cost of crude in a short period of time. The fuel today is the Fed's non taper and new age tech. If GOOG remains over $1000, one source of fuel for the parabolic move remains intact. Of course, a little off the radar and general news headlines is that fact the dollar is getting smashed while our biggest creditor China has seen its currency reach record levels. The reserve currency status of the dollar is under attack and a central focus in the Middle Kingdom. It's hard to see zero borrowing costs lasting forever for the U.S. The takeaway here is that there is more room to the upside, but risks are certainly higher and some old fashioned tape reading will come in handy.

This week video we will cover the usual market internals, the dollar, GOOG and an interesting chart of the ever expanding balance sheet of the FED.

Every week you'll gain actionable insight with: