June 21, 2020

Weekly Market Outlook

By Keith Schneider

US Equity Markets closed up on the week, led by the NASDAQ 100 which was up +3.5%. The news of a spike in the spread of the virus, triggered Apple to close stores in several states. That hit the tape late Friday and equity markets promptly sold off, closing on their daily lows.

US Equity Markets closed up on the week, led by the NASDAQ 100 which was up +3.5%. The news of a spike in the spread of the virus, triggered Apple to close stores in several states. That hit the tape late Friday and equity markets promptly sold off, closing on their daily lows.

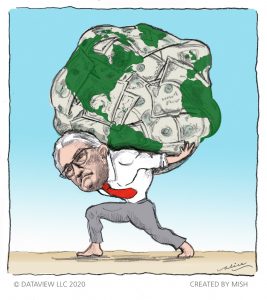

The rally early in the week fizzled after the Fed announced that it will directly buy corporate debt (or any financial asset), regardless of its quality to levitate the market. This unprecedented desperate move cuts out the middleman, the ETF providers. Another theory (mine) is that Powell’s real agenda is to make all those new Robin Hood traders look smart.

This week’s highlights are:

Stay Safe and Best Wishes for your trading

Keith Schneider

CEO - Marketgauge.com

Every week you'll gain actionable insight with: