May 22, 2016

Weekly Market Outlook

By Keith Schneider

Tom Cruise in “Jerry Maguire”

Tom Cruise in “Jerry Maguire”

This week three out of the four key US equity indexes posted modest gains after several weeks of declines that digested the rally off the February lows. The tech laden NASDQ 100 after good performance in 2015 has stalled this year and even after Friday’s excellent performance still remains down almost 5% this year. Meanwhile, the big caps (S&P 500) remain flat YTD. The shakeup resulting in far right political parties getting elected or gaining followers throughout the world highlighted by elections in Austria is not a positive for equities.

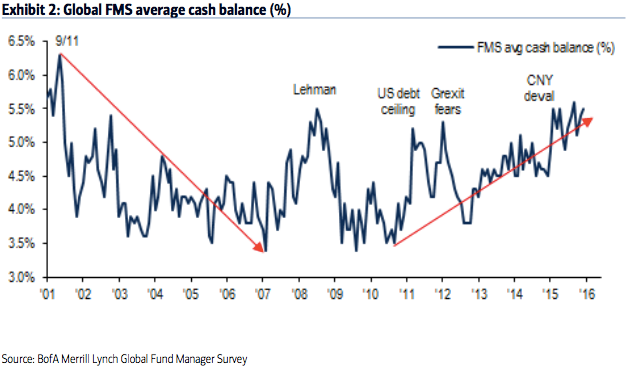

Consistent with political turmoil and uncertainty is that the monthly survey conducted by Bank of America of large fund managers shows that they are still sitting on piles of cash at levels equal to 2008 when Lehman went bankrupt.

Since this works in an inverse fashion, this indicator is now bullish for stocks. Reversing the trend of high cash levels would be a “Show me the Money “moment and indicate positive money flow and that a real move up is underway.

Meanwhile, allocations to commodities, Gold and the Gold mining sector are the out performers this year by huge margins. Gold Miners are up almost 80% over the past 6 months. Sugar is having a sweet time and back to levels not seen for almost 18 months. In our weekly outlook dated March 13 we highlighted CANE a sugar ETF and that has moved up almost 12% while stocks have edged up just 1%, and on Friday sugar closed up 1.4% making new multi-year highs. Considering that soft commodities are down 45% from 2011 highs and we are experiencing extremes in temperature there is a lot more upside possible.

Every week you'll gain actionable insight with: