September 15, 2014

Weekly Market Outlook

By Keith Schneider

Albanian Central bank governor Ardian Fulliani was hauled away and arrested for “abuse of power” after literally handing over all three sets of keys ( meant to be distributed to three different individuals) to his vault manager of the bank storage facilities where old currency is stored, resulting in the theft of $6.6 million dollars. Vault employee Ardian Bitraj confessed to the thefts last July and said much of the money was lost on World Cup soccer bets gone bad. So far 19 employees of the central bank were arrested in the incident. You might say the Albanian central bank was literally leaking Lek’s. One Albanian Lek (local currency) is worth about one tenth of one percent of a dollar. That is a lot of Leks and most likely a fraction of what really is missing.

Albanian Central bank governor Ardian Fulliani was hauled away and arrested for “abuse of power” after literally handing over all three sets of keys ( meant to be distributed to three different individuals) to his vault manager of the bank storage facilities where old currency is stored, resulting in the theft of $6.6 million dollars. Vault employee Ardian Bitraj confessed to the thefts last July and said much of the money was lost on World Cup soccer bets gone bad. So far 19 employees of the central bank were arrested in the incident. You might say the Albanian central bank was literally leaking Lek’s. One Albanian Lek (local currency) is worth about one tenth of one percent of a dollar. That is a lot of Leks and most likely a fraction of what really is missing.

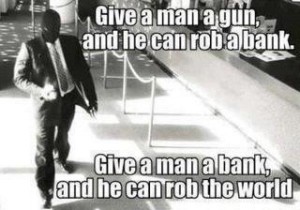

The uncovering of the crimes are politically motivated as the new Albanian government is trying to get into the EU and trying to clean up what is considered one of the most corrupt countries in Europe highlighted by Transparency International. Russia and the Ukraine are ranked even worse, which is hard to fathom, but let’s not forget they do not have a monopoly on cronyism and corruption. Western countries and financial institutions just have perfected corruption as a high art and on a bigger global level. It’s rather crude to steal a relatively small amount of physical currency. Collusion and corruption sponsored by western countries and their financial institutions have compiled a most impressive list. Here are our favorites:

1) Fixing of Libor Rate

2) The fixing of the London Gold Fix

3) The mysterious disparity between demands for physical gold versus what is reported by big banks, who are the custodians for the physical gold,

3) The mortgage scandals that brought us the 2008 meltdown

4) Insider trading scandals on a Multi- Billion dollar level

5), High Frequency Trading sponsored by the Exchanges and virtually sanctioned by the SEC

This is our short list of things that just pop right up, but there is a lot more. Considering the Fed and central banks around the world are pumping money into the global economic system at an unprecedented level and are still concerned about deflation, what is a trader investor to do? The consequences of this massive experiment are unknown. When and where this excess liquidity flows to can only be known and followed by classic trend following and relative strength analysis. Classic economic modeling will be modified years after the unintended consequences play out.

The key US stock indexes hit the pause button amid choppy action and had its first down week in over a month. Improving economic numbers hurt the bond market and gold tanked as it hates higher rates. Meanwhile Geo-Political news provides the proverbial wall of worry, as the Equity markets consolidate at the highs.

Every week you'll gain actionable insight with: