October 5, 2025

Weekly Market Outlook

By Geoff Bysshe

Confusion Rewards Bulls, Not Bears

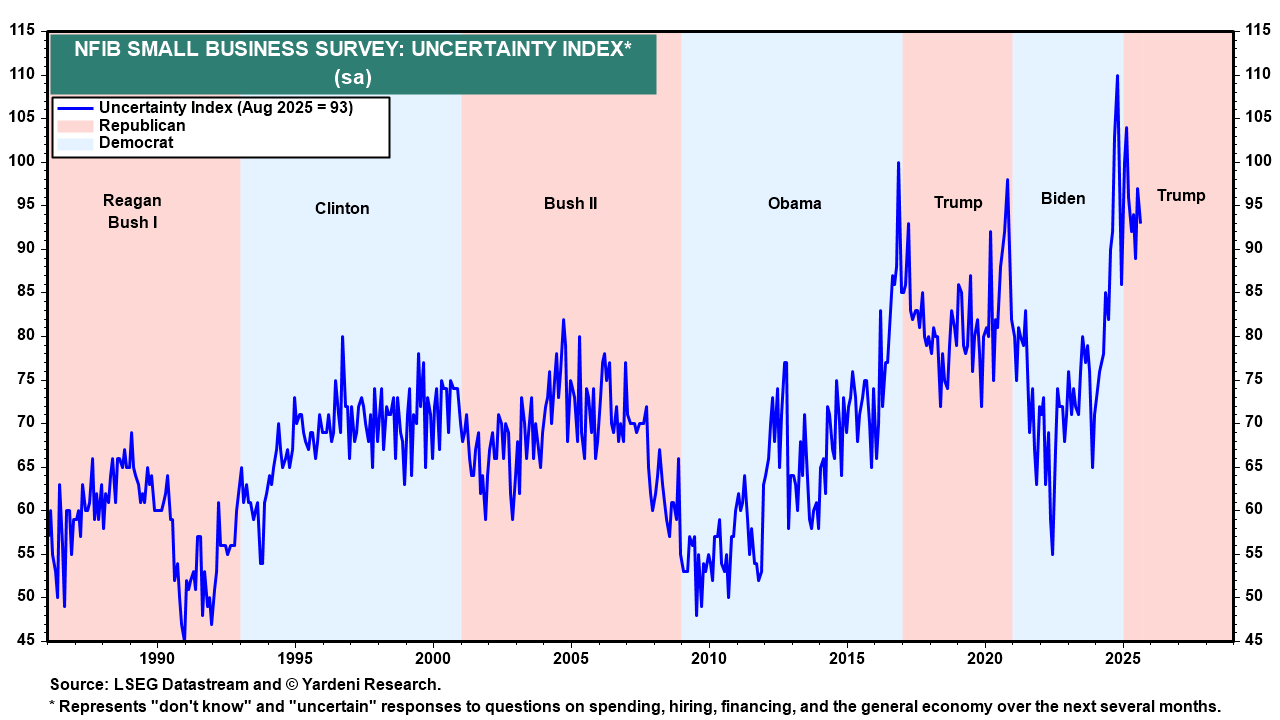

As we head into the 4th quarter of what has been a year marked by historical uncertainty. The chart below shows one measure of it based on a survey of small businesses. There isn’t any sign that the pace of potentially confusing news flow will slow down.

Hopefully, the trend of declining uncertainty that occurred in the chart above during the beginning of the last Trump administration will repeat. This would indicate businesses adapting as they did until the Pandemic created a new disruption.

However, given the record levels of uncertainty and the administration’s tactical preferences for leading initiatives with shock and volatility, the uncertainty level is unlikely to decline to “normal” levels.

Fortunately, markets have adapted. The bulls have become more resilient to extravagant news.

Unfortunately for the bears, they seem to find the environment of elevated uncertainty ripe with opportunity, which keeps ending in disappointment.

As we’ve described in many ways here in the past, bull markets can be complicated if you:

Keeping market analysis simple means sticking to basic analysis of the first principle trends that drive bull markets, and having confidence in your risk management strategies. This will keep you on the right side of the biggest trends (up or down).

There’s Will Be Plenty of Bearish Noise

New tariff announcements are not going to stop. Two weeks ago, additional tariffs of 100% were announced targeting certain pharmaceutical imports, 25% tariffs on heavy-duty trucks, and 50% on bathroom vanities, and more.

Last week, news of a deal between Pfizer and the government on drug pricing and tariff relief sent healthcare stocks soaring.

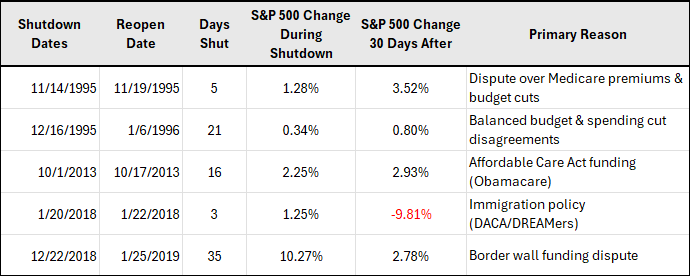

The government shutdown is a big distraction, but not a bearish market concern. The news flow will be ugly around the shutdown, but as you can see from the table below, a shutdown is not a problem for stocks, at least not in the short-run.

Be Careful Reading the Table Below

The table below is a small sample of government shutdowns. As you can see Trump holds the record for the longest government shutdown. It lasted 35 days, starting on December 22, 2018.

While the table suggests that the market was not impacted, and in fact was bullish during the 2018 shutdown, it’s important to remember the context.

At that time, the market had been selling off substantially, and on 12/24, the Fed reversed its monetary policy and began cutting rates. This is what sparked the market rally – not the shutdown.

Nonetheless, the shutdown didn’t prevent the market from responding with the bullish move one would expect.

This week, I recorded the weekly video, so I’ll limit this commentary to the following two charts that relate to how September foreshadows October and the October seasonal trends.

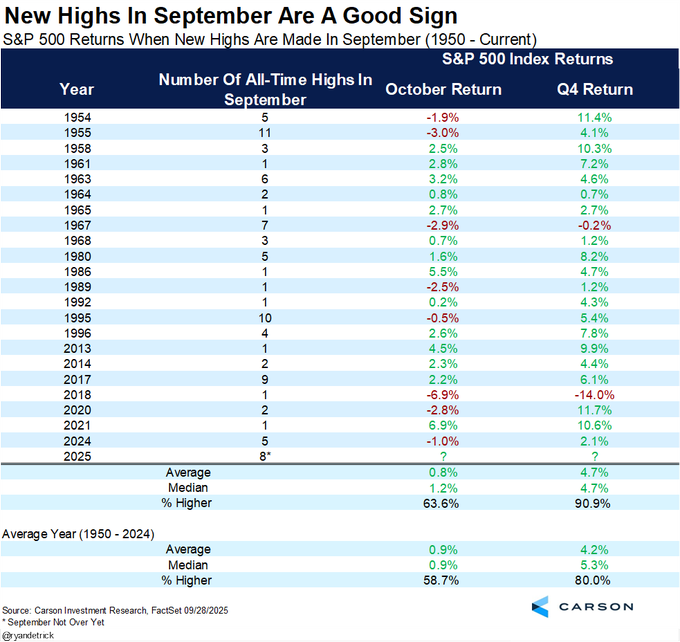

September was a big disappointment (for the bears).

The news flow leading into September was a constant message that the recent seasonal bearish pattern for the month would repeat.

Not only did the markets rally, but they also created an opposite situation in which September's performance now foreshadows a bullish October and Q4, according to the work of Ryan Detric at the Carson Group shown below.

In summary, when September posts new all-time highs it is a good sign for the rest of the year.

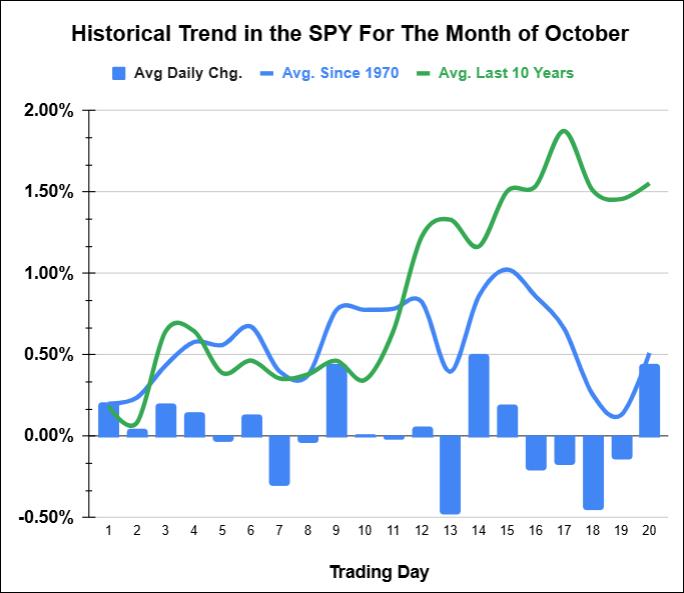

Furthermore, as shown in the chart below, October has been bullish, especially over the last 10 years.

How Will You Know If This Time Is Different?

I was concerned about the bearish seasonal pattern of September as we approached it. However, at MarketGauge, we have some simple and effective trading tactics to keep our emotions in check and our trading in the direction of the actual trend (as opposed to the trend we think is going to happen).

One such tactic is to use the first trading day of the month as an “opening range” and trade it accordingly.

This worked perfectly and easily in keeping you bullish in September. I’d use the same tactic again in October.

Best wishes for your trading,

Geoff

|

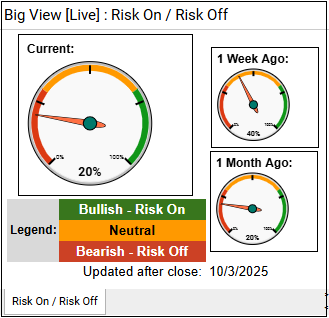

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts. Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral. The video analysis dives deeper. |

Summary: Markets surged to fresh all-time highs across the major indexes, with strong sector leadership from healthcare and semiconductors, improved internals, and both domestic and international equities holding firm bull phases. Gold’s strength remains a rare counter-signal, along with weak risk gauges.

Risk On

Neutral

Risk Off

Every week you'll gain actionable insight with: