October 31, 2015

Weekly Market Outlook

By Keith Schneider

“He had me down

“He had me down

But I put up a fight

I saw those teeth

And I groped for my knife “–Joan Armatrading

Equity Markets roared this October, ending the wildest most volatile month of the year up around 10% and well off the August lows.

In the process, it destroyed many bears. Many leading hedge fund managers reported losses of 20%. Dovish action from the Fed, the ECB and the lowering of rates by the central bank of China all fueled the markets that had deeply oversold market internals with high levels of cash on hand.

This rally occurred amid the backdrop of Russia upping the ante in Syria. Saturday morning, rumors emerged that a Russian passenger airliner that crashed over the Sinai killing 220 civilians, was shot down by ISIS. Retaliation for Russian intervention in Syria. How Putin plays this one out will be interesting.

Add into the Geo-Political mosh pit is that Iranian authorities arrested a visiting US oil executive who naively thought lifting of sanctions meant that has peace broken out between Iran and the West.

It’s understandable that one might surmise Iran’s Ayatollahs would welcome a return to the global economy and the easing of domestic hardship. But it appears not to be the case.

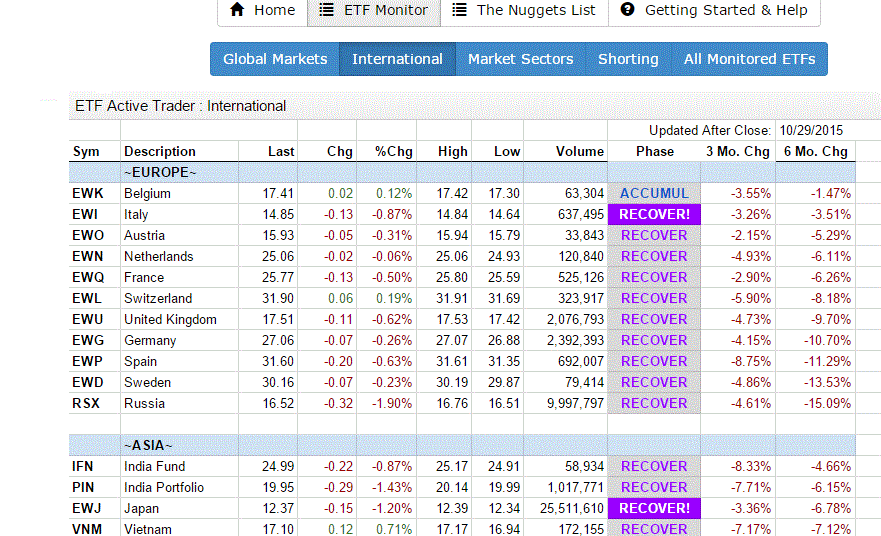

The October rally left the NASDQ 100 up almost 10% for the year, leaving the SPY and DIA around flat, with the Russell 2000 (IWM) down almost -4%. Taking a look at markets globally, the picture looks more like a scene out of the “Walking Dead”, with global equites markets wandering around like Zombies, bleeding red.

Looking at the International tab on our ETF Monitor, the 3 or 6 month returns on Global Equites are all negative. In fact, the only stock index showing meaningful gains is here in the US and that’s NASDQ. The question remains: Is NASDQ a leading indicator, or an anomaly?

The US economy grew at 1.5% last quarter and the Consumer Price Index is well below the targeted 2% by the Fed.

The feedback loop of Yellen not raising rates but threatening to do so amid mixed economic data, continues to have the desired effect on US Equities.

Also noteworthy is that physical Gold held by the NY Fed is being repatriated at an alarming rate. Seems like countries want to keep the yellow metal close to their hearts and under their beds. The NASDQ 100 ended with a bearish engulfing pattern on Friday although after the massive rally, some profit taking was not unexpected.

Across all these crosscurrents, let’s see what charts are telling us now.

Every week you'll gain actionable insight with: