September 30, 2018

Weekly Market Outlook

By Geoff Bysshe

It’s said that the market doesn’t like uncertainty, yet it’s also known to “climb a wall of worry”.

It’s said that the market doesn’t like uncertainty, yet it’s also known to “climb a wall of worry”.

The market also tends to perform better when Washington D.C. is in a state of political ‘gridlock’.

This makes sense since an ineffective Congress could be viewed as creating a sense of ‘certainty’ that the status quo will prevail.

Considering these tendencies by the market, it would be easy to assume that the period around the mid-term elections would be a rocky and inconsistent time for stocks, because of the potential for unexpected changes.

However, the data suggests otherwise.

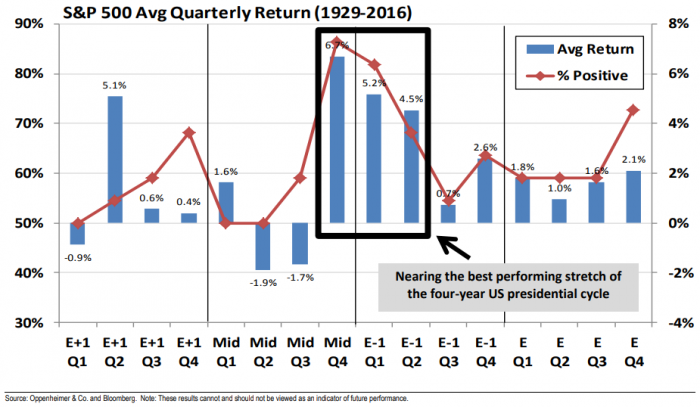

According to Oppenheimer & Co.’s technical analyst, Ari Wald, “Q4 of midterm years through Q2 of pre-election years have been the best nine-month stretch of the four-year U.S. presidential cycle since 1929,”

Not only has this period been the most bullish, it’s gains have also been quite significant. This is illustrated by his chart below.

As you can see by the 3 quarters outlined in black, this period stands out.

In addition, you can see that the 4th quarter which contains the election, has been positive about 87% of the time with and average return of over 6%.

In fact, it’s the most bullish quarter of the entire 4 year election cycle based on both average gain and percentage of positive outcomes!

Of course, this doesn’t mean the market will go straight up, but it does put a different perspective on all the bearish spin the media tends to attribute to the ‘uncertainty’ of the mid-term elections.

Here are the areas of particular interest in the free and premium($) areas of BigView this week.

There will not be a video this week.

Every week you'll gain actionable insight with: