Tug of War: Bulls vs. Fear

This week, the economic data gave both the bulls and the bears something to justify their position.

Unfortunately, for the bears, the fear of inflation and a weakening job market isn’t slowing the bulls down.

In fact, previously cautious areas of the market joying the bulls party this week.

Are the bull confident in the economy, the Fed or both?

Last week the market had a pretty strong opinion.

In this week’s issue we are releasing a new section…

“Actionable Trading Guidance”!

Inflation

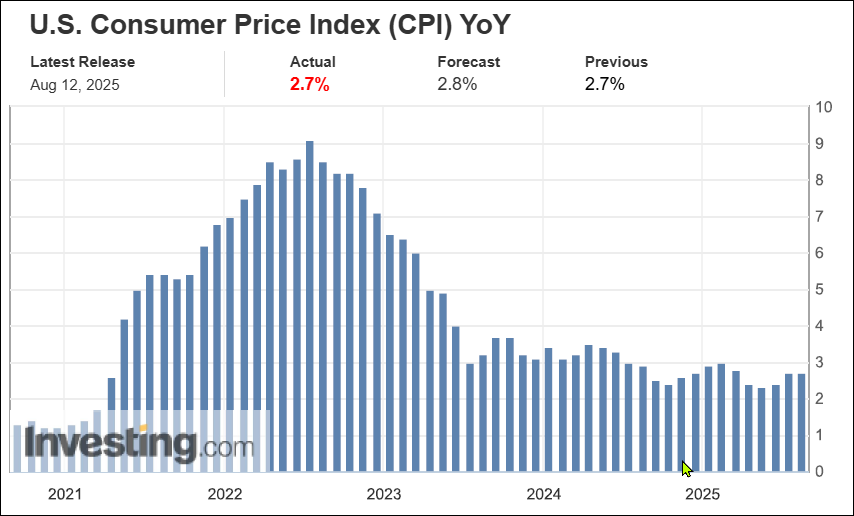

On Tuesday, CPI was reported as slightly better than expected.

As you can see from the chart and data below, the reported 2.7% inflation rate beat the expectations of 2.8%. However, the trend hasn’t improved, the report matched the previous level at 2.7% below, and 2.7% remains well above the feds target. Nonetheless, this further in emboldened and the bulls enough to rally the beleaguered and interest rate sensitive areas of the market like small caps and the housing sectors.

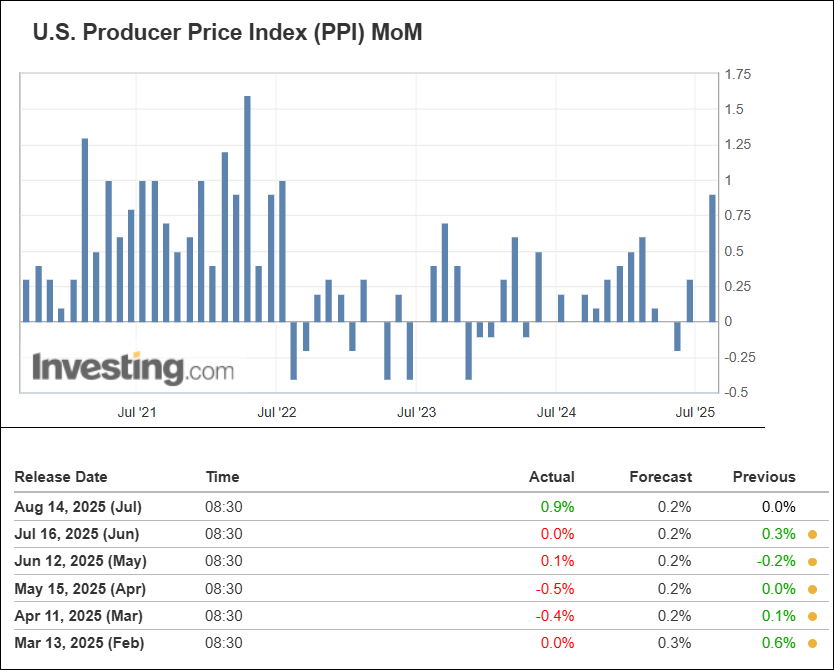

On Thursday, the inflation picture became less complacent when PPI came in hotter than inspected.

As you can see from the chart and data below this report was much hotter than expected, the hottest since July 2022, and it breaks a streak of better than expected reports since February.

Sentiment

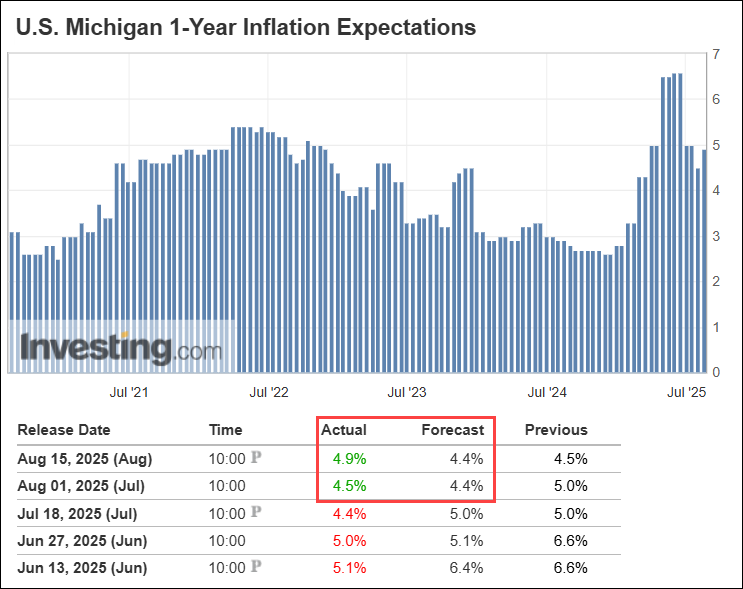

As you can see from the chart and data below the Fed isn’t the only one worried about inflation.

The trend in recent months of diminishing fears took a turn for the worst in this weeks U Mich survey.

The Labor Market

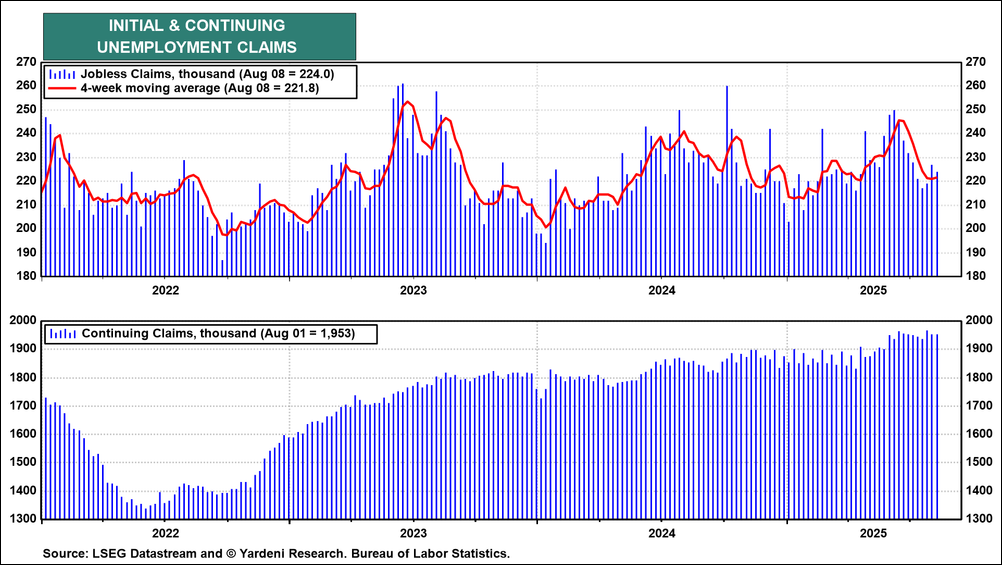

Ed Yardeni, who has called the bull market brilliantly, summarizes the labor market like this…

“Jobless claims remained low during the week of August 8 (chart). That suggests that layoffs remain subdued. On the other hand, continuing claims remain relatively elevated, indicating that it may be taking longer to find a job.”

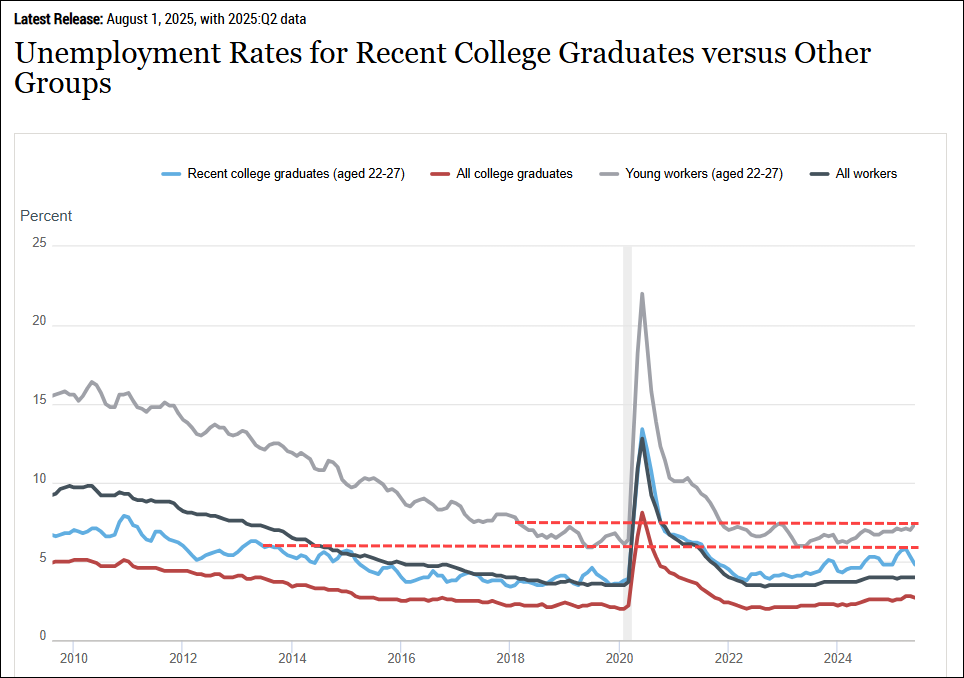

Unemployment

It’s not only hard to find a job when you lose one. As you can see from the data below it’s difficult to find a job if your young and or recently graduated.

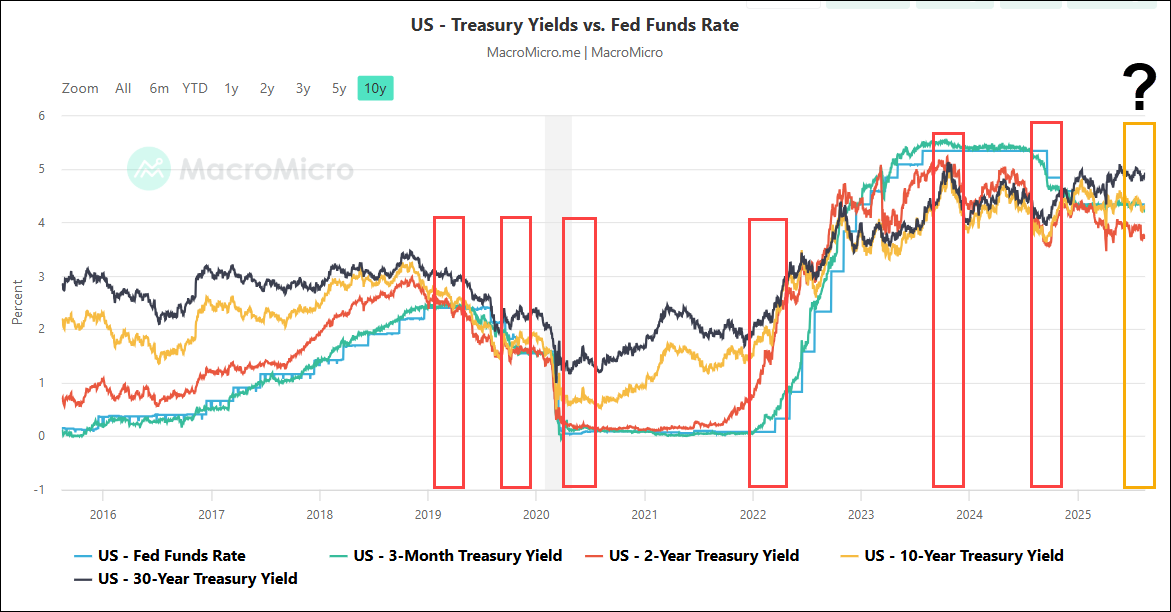

Interest Rates

In the balance between inflation and a slowing labor market is optimism for a Fed rate cut.

The 2-year note is often looked at as a market indicator for the future direction of Fed Funds.

The redboxes in the chart below indicate where the Fed shifted policy or paused. Notice the trend or change in trend in the red line (two year notes) around these time frames.

Currently, there’s been a significant period in which many have argued that the Fed should cut with the justification of where the two year being substationally lower that the Fed funds rate housin.

So why should we believe that the time is now?

Rate Sensitive Housing Sector

One sector that is likely to move higher on the belief that lower rates are in the near future is the housing sector. Perhaps last week’s move up above critical resistance levels in the housing sector (XHB, shown below) and the small caps (IWM) is good reason to believe September will be the month that the Fed cuts.

It could also indicate that regardless of the Fed, short term rates could go lower.

Looking Forward

Lower interest rates would likely favor the market’s ability to broaden out, and that would be bullish. However, the bull has demonstrated that sectors less sensitive to interest rates like big tech and semiconductors are willing to run regardless of what the Fed does.

It’s a tough time to be bearish, but a dangerous time to be complacent.

Our simple rule of thumb for discretionary traders is stay with leaders trading above their July calendar range high and avoid areas of the market that fall below their July calendar range low.

This keeps your work simple in the summer and sets you up to be well positioned into the fall.

|

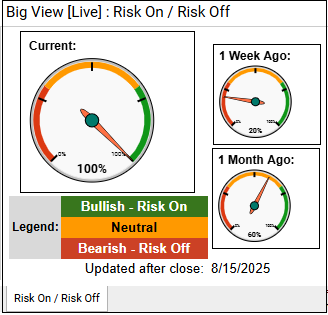

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts. Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral.

The video analysis dives deeper. |

Summary: Markets rose with strong gains in small caps, new highs in the S&P and Nasdaq, positive sector rotation, and leadership from clean energy and solar, while volatility fell to its lowest level since December and risk gauges moved fully risk-on. Neutral signals include mixed market internals, even distribution/accumulation volume, and short-term overbought conditions in large-cap foreign equities, with Bitcoin, gold, and fixed income remaining range-bound.

Risk On

- Markets were up between 0.5% and 3.1% on the week with a surge in small caps and new all-time highs in S&P and Nasdaq. (+)

- Sector rotation looks positive with consumer staples down and transports, retail, biotech, and consumer discretionary all up strong on the week. (+)

- Solar and Clean energy were among the strongest performers this week. Clean energy has been lagging for years. (+)

- The new high new low ratio for the S&P is above the 10 Day Moving Average with positive slopes across the board. (+)

- Risk gauges improved to fully risk-on. (+)

- Volatility continued to come off this week, reaching its lowest levels since last December. (+)

- Value still is under its all-time highs while growth has pushed to new highs. Both value and growth are in bull phases. (+)

- The Economic Modern Family improved significantly with strength in IWM, IBB, and XRT, while semiconductors took a bit of a breather from its strong recent price action. (+)

- Large cap foreign equities, on a short-term basis, regained its leadership over the S&P benchmark but hit overbought levels and may be subject to some mean reversion. (+)

- Seasonality for the major indexes is still positive going into the latter half of the month, though we have already outpaced average returns for August. (+)

Neutral

- Volume was neutral with about even distribution and accumulation days between the major indexes. (=)

- Market internals continue to lag the overall market rally, a trend for the last month. The McClellan Oscilator has a slightly negative reading of -30. We would like to see the S&P hold its 10 Day Moving Average for the short-term bullish trend to remain intact. (=)

- The 52 week new high new low ratio is more neutral for the Nasdaq. (=)

- The color charts (moving average of stocks above key moving averages) remain positive across the board on the 200-Day periods, with much more mixed signals on the 50 and 20 Day periods. IWM has the only positive 20-Day reading. (=)

- Soft commodities were strong on the week with DBA breaking out above both its major moving averages. It is outperforming the S&P on triple play for the first time since April. (=)

- Gold is still in a massive compression range since April. A breakout to the upside would likely be a negative sign. (=)

- Intraweek, Bitcoin made a new all-time high before backing off into the close of the week. A break below its 50-Day Moving Average could be a risk-off signal. (=)

- Fixed Income remains in a trading range, though getting a short-term rate cut seems likely. Unclear if the longer-end of the yield curve will respond positively to such a cut. (=)

Risk Off

For Actionable Trading Guidance:

1. Lean Risk-On but Selectively

- Focus on recent leadership: Small caps (IWM), clean energy (TAN, PBW), solar (FSLR, ENPH), transports (IYT), retail (XRT), and biotech (IBB) all showed strong relative strength and could continue higher if momentum holds.

- Growth over value: Growth indices (QQQ, IWF) remain in a bull phase and at new highs, while value is still lagging. Favor growth-heavy setups.

- Sector rotation trades: Look for long entries in sectors breaking out of basing patterns (consumer discretionary, transports) while avoiding defensive sectors (consumer staples).

2. Manage Overbought and Mean Reversion Risk

- Foreign large caps: Short-term overbought (EFA, VXUS) suggests potential pullback; consider taking partial profits or looking for short-term hedges.

- Clean energy follow-through: The sector is strong, but it has lagged for years—use trailing stops to protect gains in case the breakout fails.

3. Watch the Neutral and Warning Signals

- Internals lagging: The McClellan Oscillator at -30 and mixed 50/20-day breadth readings warn of a possible pullback if the S&P loses its 10-day MA. Keep a tactical exit plan for long positions.

- Bitcoin & Gold:

- Bitcoin (BTC) pulled back from all-time highs—failure to hold above the 50-day MA could be a short trigger or a sign of broader risk-off.

- Gold is coiled in a long compression range; a downside break could confirm risk-on, but an upside break could flip sentiment quickly.

4. Tactical Setups for Next Week

- Long swing trades:

IWM, IBB, TAN, XRT — buy on pullbacks to support or breakouts to fresh highs.

- QQQ — add on shallow dips given continued growth leadership.

- Mean reversion shorts or hedges:

- EFA / VXUS if RSI > 70 and price falters.

- Event watch:

- Monitor any Fed commentary or data that could affect rate-cut expectations—this could move financials and fixed income plays.

Stay One Step Ahead of The Markets and Profit

From The Current Volatility With Market Outlook