November 16, 2025

Weekly Market Outlook

By Geoff Bysshe

Last week’s modest pullback came with unusually sharp headlines - “biggest tech selloff since October,” “rate cut odds plunge,” and “AI debt warning.”

But the volatility isn’t about a single headline. Instead, it’s a convergence of shifting Fed expectations, conflicting economic data, and signs of fatigue in the AI-led rally.

With monetary policy in flux, October data potentially compromised, and credit markets signaling concern, investors are growing more cautious about the possibility of a deeper correction—despite November’s reputation as one of the market’s strongest months.

Let’s ask and answer the obvious questions.

Is It Fear the Fed Won’t Cut Rates in December?

The market has clearly become more concerned about the December Fed meeting. The odds of a December rate cut have fallen sharply—dropping from over 100% a month ago to under 50% last week.

Chair Powell said he wanted more uncertainty about the December rate cut and this repricing has been fueled further by a coordinated set of hawkish Fed remarks. Boston Fed President Susan Collins warned that it will “likely be appropriate to keep policy rates at the current level for some time,” while Cleveland’s Beth Hammack reiterated the need to remain “somewhat restrictive.”

The stock market will likely be unhappy if December doesn’t deliver a cut, but at least now, such a move would not be as shocking.

Is It Inflation Worries—From the Fed to the Consumer?

The inflation narrative is evolving, not fading. Bond markets didn’t rally during the recent equity selloff—instead, long-duration yields moved higher after a weak 30-year auction, spilling into corporate credit. That pushback from debt markets suggests inflation concerns are still embedded in the system.

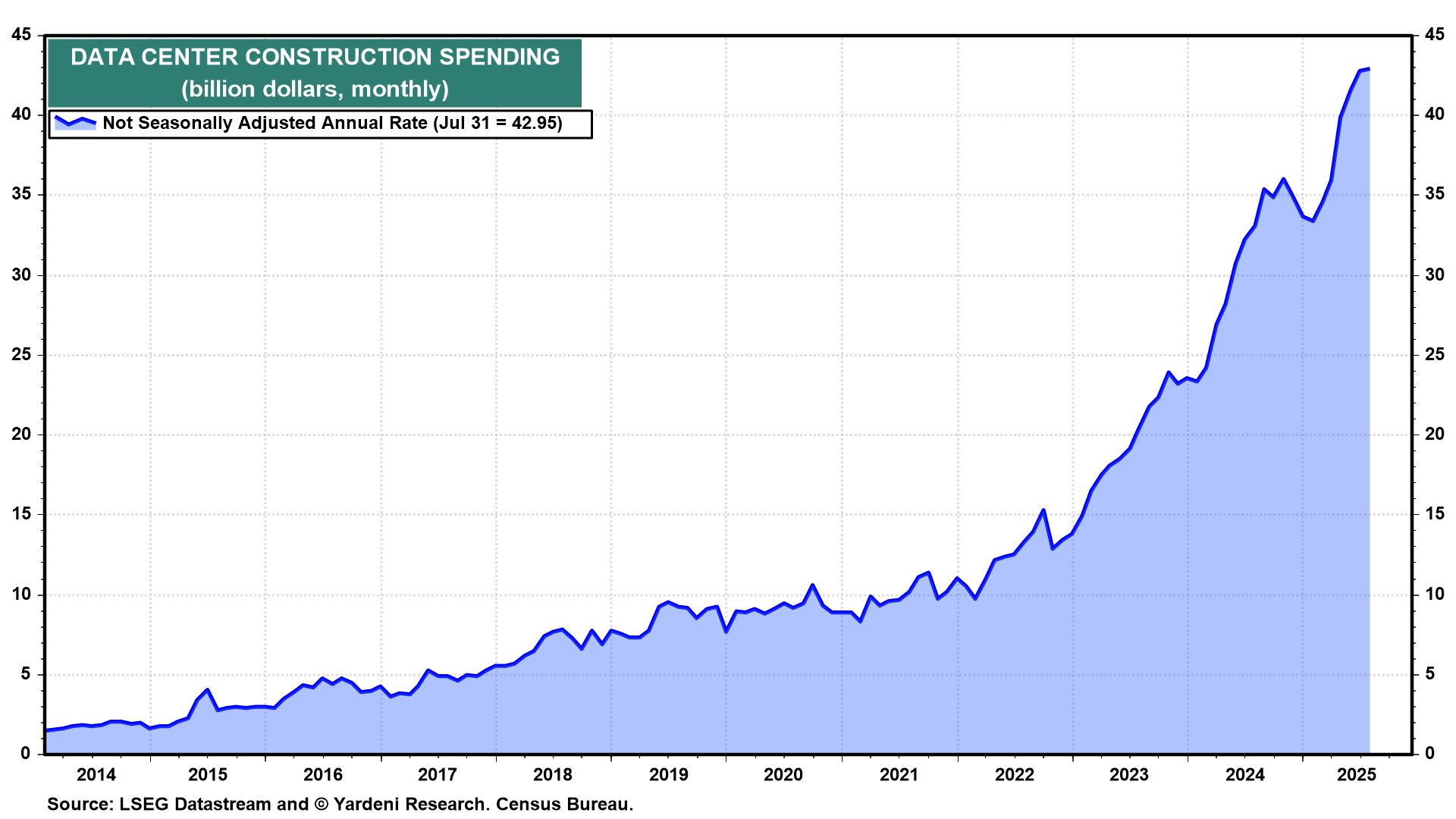

One growing—and problematic for many reasons—source of inflation concern is actually AI itself. The U.S. is home to over 4,000 data centers—more than any other country—and the spending on new data centers is climbing rapidly as shown in the chart below.

With demand for AI infrastructure accelerating, the expansion of power-hungry facilities is expected to continue at a pace few utility grids were designed to handle.

U.S. data centers consumed 183 terawatt-hours of electricity in 2024—already 4% of total national usage—and are projected to more than double by 2030. Rising demand is driving utility bills higher, with the average U.S. household now paying $142 per month, up 25% from a decade ago.

Construction costs are also surging, with the average price per square foot reaching $977 in August, up from $665 a year earlier.

It’s Not Just Data Centers

Even the President who said the isn’t inflation a few weeks ago, decided last week to encourage prices in decline in important areas like groceries.

The administration pivoted toward “affordability” messaging and announced it would ease tariffs on groceries—an implicit acknowledgment that policy may be contributing to cost pressures.

Is It Signs the Job Market Is Weakening?

Despite strong consumer spending data—October’s numbers showed a 3.5% year-over-year increase—investors are starting to question how long that strength can hold. The underlying concern isn’t about demand, but about the stability of the job market that supports it. While higher-income households continue to benefit from stock market gains and housing wealth, early signals of labor market stress remain a problem.

Verizon announced plans to cut up to 20% of its workforce—approximately 20,000 jobs—a move that suggests companies are looking to reduce costs as they approach the limit of what consumers will tolerate in terms of pricing.

The softening isn’t just anecdotal.

Additionally, in the hardest hit segment of the labor market—college graduates ages 20–24—most of the unemployed have never held a job. As a result, this area of unemployment doesn’t show up in jobless claims data, which still appears “ok” on the surface.

All of this is being compounded by a more systemic problem. Due to the recent government shutdown, October’s employment data is incomplete. The Household Survey—used to calculate the unemployment rate—wasn’t finished, and the CPI report may also be compromised.

As a result, policymakers are operating in a “data desert,” with the White House warning that the missing October data will be “permanently impaired.” For the Fed, that means flying blind

It was Chair Powell who suggested “walking slowly when you enter a dark room.”

Is the AI Data Center Boom Losing Steam?

The AI narrative has been a major driver of market enthusiasm, but recent developments suggest a more cautious tone may be setting in. There is a growing narrative that the spending should be reassessed through the lens of debt, execution risk, and tightening credit.

You don’t have to look far to find issues…

Oracle’s long-term debt—already at $96 billion—is projected by some analysts to nearly triple to $290 billion by 2028.

This is more “interesting“ when you consider the chart below. Its 30-year bonds have dropped from 106 at its last earnings report to 92, a new low for the year. The market appears to be questioning whether AI investments are being fueled more by leverage than by profitability.

This skepticism isn’t isolated. High-yield borrowers like Applied Digital, which is linked to CoreWeave, recently had to offer a 10% yield to move bonds—raising concern that risk appetite in the credit markets is drying up. These widening spreads are being viewed as a “canary in the coal mine” for the broader tech sector.

Execution risk is also rising. Microsoft CEO Satya Nadella highlighted a bottleneck that’s slowing deployment: data center shells aren’t being built fast enough to house the chips already in inventory. That physical constraint is a reminder that growth in AI infrastructure still depends on old-world logistics and permitting.

Earnings reflect the mixed signals. Applied Materials reported another quarter of declining sales and flagged continued weakness tied to export restrictions. That said, after opening 10% lower on the news, AMAT rallied immediately and closed higher for the day.

On Tuesday, CoreWeave missed its Q4 targets due to data center construction delays and dropped 16% that day, with the decline continuing every day for the rest of the week.

On the other hand, AMD projected its AI data center revenue will grow 80% annually for the next several years, and Cisco raised its outlook based on Nvidia-related demand.

The AI bull market is far from over, and it’s healthy to have significant corrections. Currently, the correction is one that is demonstrating rotation rather than broad, indiscriminate liquidation.

So Are Investors Overreacting to Normal Volatility?

Despite the headlines, the recent pullback has been relatively mild. The lowest point in the recent pullback in the S&P 500 was down about 4% at its lows.

As you can see from the dotted line that represents -4% from the all-time high, this is a normal and necessary level of volatility.

The seasonal tailwind of November may still kick in, but even if it doesn’t, corrections in the 5% to 15% range are entirely normal—even healthy.

|

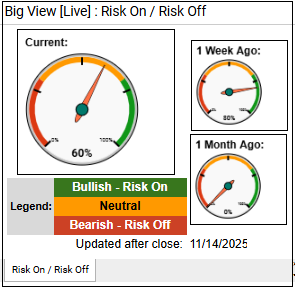

Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts. Every week we review the big picture of the market's technical condition as seen through the lens of our Big View data charts.

The bullets provide a quick summary organized by conditions we see as being risk-on, risk-off, or neutral. The video analysis dives deeper. |

Market Summary

Risk On

Neutral

Volatility back into neutral territory, off its peak, but remains elevated from its fall lows. (=)

Risk Off

1. Equity Index Positioning

Core Bias: Neutral-to-light-risk-off tilt.

2. Sector Rotation / Tactical Trades

Favor defensive growth + laggards showing improving momentum; avoid high-beta leaders.

Overweights / Buys

Underweights / Avoid

3. International Equities

Continue overweight but tighten risk.

4. Bitcoin / Crypto Positioning

Treat as risk-off until proven otherwise.

5. Rates / Macro Risk Management

6. Seasonality Considerations

7. What Would Flip the Plan to Risk-On?

Only increase risk if these conditions occur together:

8. Stops, Sizing, and Risk Controls

Every week you'll gain actionable insight with: