April 16, 2016

Weekly Market Outlook

By Keith Schneider

US Equity markets returned to the party, and headed back to the bar to get another tasty beverage. Key indexes closed up over 1 % for the week. The S&P 500 made new YTD highs and is now up 2% this year. Last year’s leader the NASDQ 100 still lags and is down -1% YTD. As the stock market continues to rally with economic activity remaining lackluster and US Industrial output declining .6 % last month continuing it 7-month downtrend, the disconnect between price action and economic activity persists. Economic activity is the lowest since August 2010. Many other indicators are contracting like consumer confidence. JPM (JPMorgan Chase) failed its stress test but has rallied sharply while C (Citigroup) passed its federal checkup with flying colors but its performance is lagging far behind that of JPM. JPM off the books derivative exposure and overall leverage is alarming. Last year, derivative exposure at the 6 largest banks totaled 278 trillion on about 10 trillion of equity.

US Equity markets returned to the party, and headed back to the bar to get another tasty beverage. Key indexes closed up over 1 % for the week. The S&P 500 made new YTD highs and is now up 2% this year. Last year’s leader the NASDQ 100 still lags and is down -1% YTD. As the stock market continues to rally with economic activity remaining lackluster and US Industrial output declining .6 % last month continuing it 7-month downtrend, the disconnect between price action and economic activity persists. Economic activity is the lowest since August 2010. Many other indicators are contracting like consumer confidence. JPM (JPMorgan Chase) failed its stress test but has rallied sharply while C (Citigroup) passed its federal checkup with flying colors but its performance is lagging far behind that of JPM. JPM off the books derivative exposure and overall leverage is alarming. Last year, derivative exposure at the 6 largest banks totaled 278 trillion on about 10 trillion of equity.

China’s growth is now under 7% and if you even believe the Party’s prognostication that its worst growth numbers (since Nixon returned from China) are over, it’s still a drag on global growth.

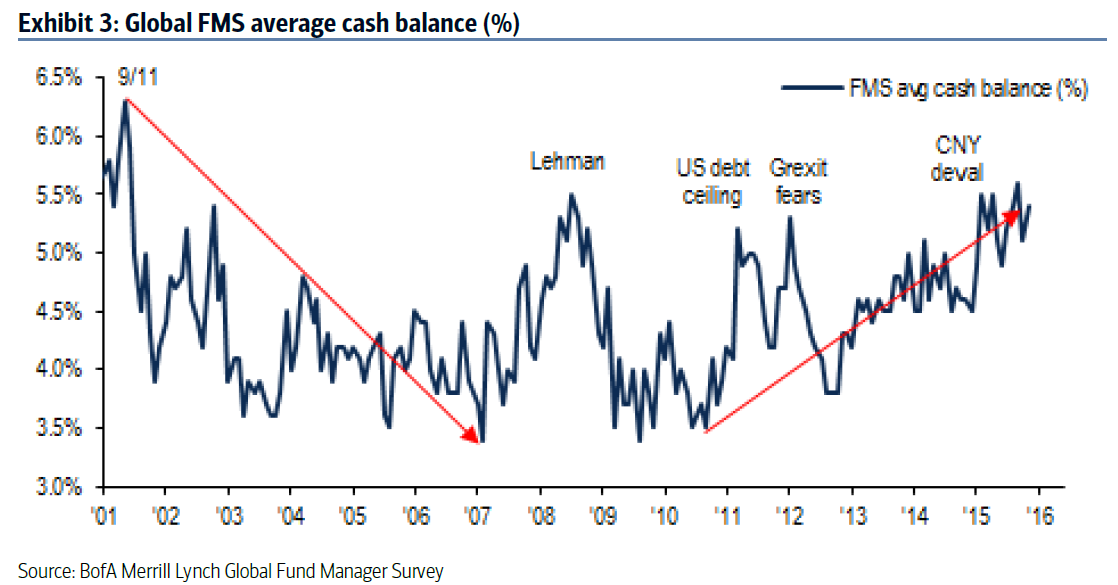

Meanwhile, Cash levels of fund managers remain almost as high as they were during the financial crises of 2008 and continue to climb.

The washout in January and February occurred on heavy volume while the rally over the past 8 weeks has occurred on light volume. The Russel 2000 (IWM) has not closed above the 200 day moving average since early August 2015. That is, until this past Friday.

The adage of don’t fight the tape has never been more pertinent. In fact, we can take it one step further and only read half the tape as volume numbers are a distraction. Jessie Livermore would be focusing on pure price action and playing the surge in metals and commodities. Especially noteworthy is that silver’s finally catching fire and gaining on gold which is more indicative of emerging inflationary pressures. Metals and metal mining continue to be a leading sector with GDX now up a sizzling 63 % over the last 3 months.

Every week you'll gain actionable insight with: