February 24, 2016

Mish's Daily

By Mish Schneider

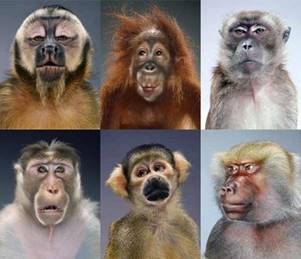

Economic Modern Family or Monkey Troop

Finally, a photo of the Economic Modern Family in their current iteration this Year of the Monkey!

Last night I wrote, “this year, more than ever before, I am more fixated on the macro picture and particularly how my one index (IWM) and 5 sectors (XRT, IYT, SMH, KRE, IBB) are doing.”

I then proceeded to bring you each member’s current status concerning momentum, as measured by our proprietary indicator.

The first sign of momentum waning on the downside came when the Transportation sector (IYT) so clearly began to outperform the S&P 500 on February 4th.

Thereafter came the head’s up that the momentum indicator showed IYT going from negative to positive. Then, there was its phase change to Recovery.

As Monkeys are known to imitate with a purpose, I waited for another member to join in on the positive momo fun. Lo and behold, Granny Retail (XRT) tried. Although XRT continues to signal negative momentum, the phase to Recovery is a good start.

Let’s not get too ahead of ourselves Granny and Tranny; Granddad Russell 2000 (IWM) has to give you his alpha monkey seal of approval!

With neither a Recovery Phase in its midst or a flip from negative to positive on the momentum indicators, Granddad IWM could just be giving hopeful bulls nothing more than a bear market rally.

However, even the highest ranking alpha monkey of the troop will bow down to a family subordinate if he loses a fight.

Interesting if Granddad submits to Granny. Interesting but not altogether surprising, as Retail does hold the key to consumer sentiment and personal spending.

An improvement in sentiment among consumers will help small cap companies and other sectors of the economy to a large degree.

Yet, let’s not get too ahead of ourselves.

“Monkey See, Monkey Do.”

Research shows that although Monkeys imitate, they do so with limited knowledge and/or concern for the consequences.

Furthermore, our Monkey troop is also comprised of Biotechnology, Regional Banks and Semiconductors.

Monkeys in troops do not leave their children unattended nor their injured family members without food and water, to a point. Weaker members could be left behind over time, especially if it means they create a liability to the others in the troop.

Therefore, watch how IBB, KRE and SMH do in comparison to XRT and IYT. Semis are in the best shape, closest to the 50 DMA. IBB and KRE have plenty of catching up to do.

Granddad IWM has 3 paths to choose from. He could retake his status as alpha and make a high volume effort towards 104 (the 50 DMA). He might also decide to hold up the rest of the troop to care for his weaker offspring IBB and KRE. Also possible, IWM submits to XRT and IYT dawning an era with a new alpha in town.

S&P 500 (SPY) Through 195 will be impressive. And it has to hold 190

Russell 2000 (IWM) 102 resistance to clear. 99.00 underlying support at the 10 DMA

Dow (DIA) 166 the 50 DMA to clear or just a bear market rally

Nasdaq (QQQ) 103.50 is monthly resistance to note with105 the 50 DMA. Support now at 100.40

Volatility Index (VIX) Last night, “Bounced off the 50 DMA and might have more upside to 26.75.” Today’s high 26.65, close enough

XLF (Financials) 20.87 the 200 week moving average pivotal-closed today under

KRE (Regional Banks) Held support but needs to do way more. 35.81 pivotal

SMH (Semiconductors) 50.00 big resistance with the 50 DMA just above. 48.25 minor support to hold

IYT (Transportation) Dropped real close to 128 then rallied. If you don’t watch my tweets, I pointed that out and said it had to clear 129-way before the turnaround began. IYT rules right now. If today was the dip to buy, then we should see a move over 132 now

IBB (Biotechnology) Last week’s high 267.60. If this can move over there, great sign

XRT (Retail) Granny led the charge today-43.25 next key resistance to clear

GLD (Gold Trust) Amazing how many bears out there. Don’t know why. This is building a new base above 115.

GDX (Gold Miners) Another new multi-month high close

USO (US Oil Fund) Momentum to downside seems over with. Question is, does that mean any kind of substantial rally to follow?

TAN (Guggenheim Solar Energy) 22.67 this week’s high after a big move up in First Solar post earnings. Like to also see momentum shift here

TLT (iShares 20+ Year Treasuries) Of course, a neighboring troop of monkeys comes in the form or rates. In order for our family to fight them off, we have to see TLTs fail 128.50

UUP (Dollar Bull) Back over the 200 DMA

Every day you'll be prepared to trade with: