October 25, 2011

Mish's Daily

By Mish Schneider

Earnings season has not been kind to the leading stocks AAPL IBM and now AMZN. Let's not even talk about NFLX-that fall from grace happened quite some time ago. The recent run, which came to a screeching halt today, was led by retail (XRT) and energy (XLE) and as I wrote last night, both were very overbought and due for a selloff. What happens now? Given the accumulation phase in QQQ and recovery phase in SPY IWM DIA, even with lower prices, do not see a meltdown here but would certainly not rush into buying until market internals improve. Today was the first distribution day in volume since October 7th in SPY. Volume patterns over last 2 weeks-light but positive.

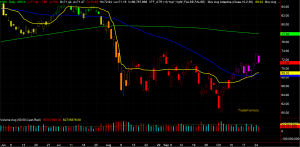

SPY The danger of clearing a price without big volume. 123.50 now pivotal with support at 122.10. Big note: If SPY closes above the 80 monthly moving average by end of the week, will be the first time since July.

QQQ If you watched the leading stocks today, they were your first clue.

IWM* 71.16 yesterday and today's low. Since the leaders are in the hospital, now watching midcaps to make the next move.

IWM* 71.16 yesterday and today's low. Since the leaders are in the hospital, now watching midcaps to make the next move.

ETFs:

GLD Cleared the top of the recent range with first good day of volume since September 26th. Overhead at the 50 DMA 169.35 with overhead gap should it get really going at 172.20.

XLK (Technology) 25.50 pivotal, 24.80 EMA support.

SMH (Semiconductors) Could not clear the 200 daily moving average. Let's see if gets to and if does, what happens at 30.00. Also notable is the doji day at 31.31 pivotal

XRT (Retail) Inside day with next support at 51.20. Would like to see more digestion before a new long entry

IBB (Biotechnology) Typically a leading sector/group, has not closed above the 200 DMA since early August. Let's see what happens at the 50 DMA.

XLF (Financials) 13.00 now key support and closed right there. So, either it will go to 12.48 again or clear 13.48. Lots of noise in the middle

OIH (Oil Service Holders) I often write about this as a first choice on down days to short. But, the whole range was made in the first 30 minutes then it just chopped around.

For more detailed analysis join me, along with hundreds of other subscribers, at Mish's Market Minute and get my daily trade picks, trade alerts, training videos, and exclusive analysis tools. Sign up for Mish's Market Minute now and get a free 2 week trial!

Every day you'll be prepared to trade with: