May 15, 2011

Mish's Daily

By Mish Schneider

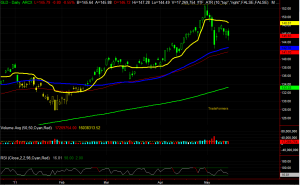

Last week was tough! We got so close to looking like we were going to breakout to new highs in QQQ only to wind up closing down 1.2% breaking the adaptive moving average, yet holding last week's low. And we did not have yet another Distribution day in volume. SPY is smack in the middle of the range over the last two weeks and actually had an inside day on Friday. Slope on the 50 day moving average on both is still pointing up and the 60 minute chart had a wedge which we closed on the bottom of but did not break. IWM is still holding the 50 day moving average at 82.93, but did close at the lower end of the range. The 50 day moving average is still pointing up. DIA also had an inside day. The slope of the adaptive moving average is neutral in all indexes. I like to use that moving average as a measure of "noise."

The best I can say is that we are still in a bullish trend, still experiencing a lack of commitment from buyers and sellers, the 100 point moves up and down present as noise, all of which is making trading difficult. But, last week we talked about having a strict plan to follow. Once you've made a commitment to a swing trade, turn off the noise. For those who are doing mini swing and daytrading, control the risk and keep track of stops and profit targets. That is the absolute best any trader can do under the circumstances. Master this discipline now when the market is tough, and I guarantee that you will be ready to take it up a few notches when the market gets easier. The best metaphor I can think of is the training that the Navy SEALs do. One exercise is when their feet are tied and their hands are tied behind their backs. Then, they jump into a pool of water and swim 50 m. Then, they have to dive down to the bottom of the pool still bound and retrieve goggles with their teeth and then swim another 50 m. The point is the preparation is harrowing so they are ready for whatever happens in the field. It's also been an extremely effective way of filtering out recruits as most drop out before training is done. Think of this as we go into next week. By having a consistent plan and learning to control risk now, imagine how smooth the mission will be if you are well prepared for all of the impediments and then there are none!

ETF's

SMH although this got dragged down with the market, still held up pretty well and had an inside day last Friday. The close of 36.75 is now the all-time new high close to beat. This still looks like the most promising ETF on the board.

FXE broke 141 and went down to 140 which was a big wall of support established during March. The dollar strengthening last Friday had a big impact on the market. Beneath 139.93 there is a gap to 139.63 from March 17. If FXE holds this 140 level, and cannot fill the gap, once again look at the dollar to start to retreat. The Euro just as the metals, have had such a dramatic fall from all time highs, it is hard to believe that they will not have some rebound at some point soon.

GLD** pretty choppy day last Friday, but overall this is still above the 50 day moving average and has the best chance of rallying especially if the dollar weakens. But really it also needs to clear 147.09 to sustain the rally.

GLD** pretty choppy day last Friday, but overall this is still above the 50 day moving average and has the best chance of rallying especially if the dollar weakens. But really it also needs to clear 147.09 to sustain the rally.

FXI went short last Friday and took off .5 an ATR before covering as I didn't want to go home short for two reasons. One is that the slope on the 50 day moving average is neutral and second because it closed above the prior day's low of 43.10.

USO** Inside day. Now, above today's high 39.61 could see a rally up to the 50 day moving average.

Every day you'll be prepared to trade with: