June 27, 2016

Mish's Daily

By Mish Schneider

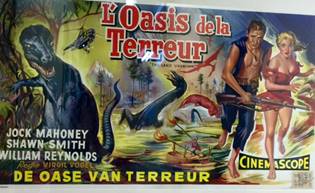

Inspired by the discovery of unusually warm water in Antarctica, this science fiction movie whose title translates to “The Land Unknown” follows an expedition gone bad. Having flown into a storm, a small crew’s helicopter crashes deep into a volcanic crater populated with perilous dinosaurs.

The market follows its own expedition gone bad. Cratering further from the Brexit volcano, the market continues to encounter many dangers in a fight for its survival.

With a drop in price below all the major moving averages, the Russell 2000 is joined by the Dow, NASDAQ and the S&P 500 into Distribution Phases.

Furthermore, Standard and Poor’s downgraded the United Kingdom from AAA/Negative to AA/Negative. Deservedly so I must add.

However, I do not need to recap what you all already know. One small interview that made its way onto Bloomberg captured my attention today. And it was with Alan Greenspan, former Chairman of the Federal Reserve.

To many, what Greenspan said might be “The Land Unknown”, but to us who traded commodities back in the day, it’s a land well known. Additionally, it’s a land I’ve been writing about since last Fall so you can imagine how interested I was to hear Greenspan’s thoughts.

Mr. Greenspan acknowledged that inflation has been low, but he expects that to change. He talked about M2 as a critical indicator of inflation. He mentioned that that number has gone straight up by 6-7%.

M2 is a measure of money supply. Cash, checking and savings deposits, mutual funds, etc. are all assets that are highly liquid. The supply has reached an all-time high of 12733 USD Billion in May 2016.

Interpretation: There is tons of money in fungible short-term assets. That means that with a record amount of cash on the sidelines, that money can easily move into anything that is perceived as “hot.”

What is “hot?”

Sugar futures have risen 30% since mid-April. Gold and miners have risen well over 27%. Although volatile, many grain prices have also seen tremendous increases in price. Any major disruption to the crops due to drought or flooding could send those prices soaring much higher.

Cotton and Coffee Futures have entered a Recovery Phase on the weekly charts. And all of this while the market is now down for the year.

About inflation Greenspan added that, “I don’t know when it’s coming,” but “I say wait” and watch because the surge is nearly certain to occur.

S&P 500 (SPY) A clean move is back to 195. But just as likely this gets back and holds 200.

Russell 2000 (IWM) 108.60 is the 200 week moving average. If holds could see a pop. If not, see 106 next

Dow (DIA) If gets back over 172.30 that will bring in buying. Otherwise, 168 next support

Volatility Index (VIX) Closed under Friday’s high

XLF (Financials) If 22 clears a relief. 21.00 daily chart support

KRE (Regional Banks) 35.00 major support

SMH (Semiconductors) 52.92 the 200 DMA still above and now major support.

IYT (Transportation) 125 support

IBB (Biotechnology) Held February low-not that I take much stock in that as a bottom but you just never know

XRT (Retail) Granny held 40.00

IYR (Real Estate) 78-80 persists

GLD (Gold Trust) Sitting just over the 200 week moving average

SLV (Silver) Has to get over 17 to see a new leg up

GDX (Gold Miners) Inside day on the highs

USO (US Oil Fund) Watching for a move back over 11.40 if holds 10.85

UNG (US NatGas Fund) Looking at the 200 DMA to clear

TLT (iShares 20+ Year Treasuries) New all-time highs-more reason to think about what Greenspan says

UUP (Dollar Bull) 25.05 the 200 DMA resistance

Every day you'll be prepared to trade with: