September 10, 2025

Mish's Daily

By Mish Schneider

This is a good time to step back and gain some perspective on my Economic Economic Modern Family as the market anticipates

I start with Transportation IYT looking at the weekly chart.

When step it back, it looks weaker than the growth stocks, however, the chart suggests nothing more than noise right now.

IYT is in a weekly bullish phase, underperforms the benchmark and the momentum is waning but not critical.

If we compare IYT to Sister Semiconductors SMH…

We see a test of the all-time highs. SMH far outperforms the SPY and momentum is good but not amazing.

The point is, we continue to watch for more signs that SMH can keep the party going for everyone else.

Meanwhile, looking at everyone else..

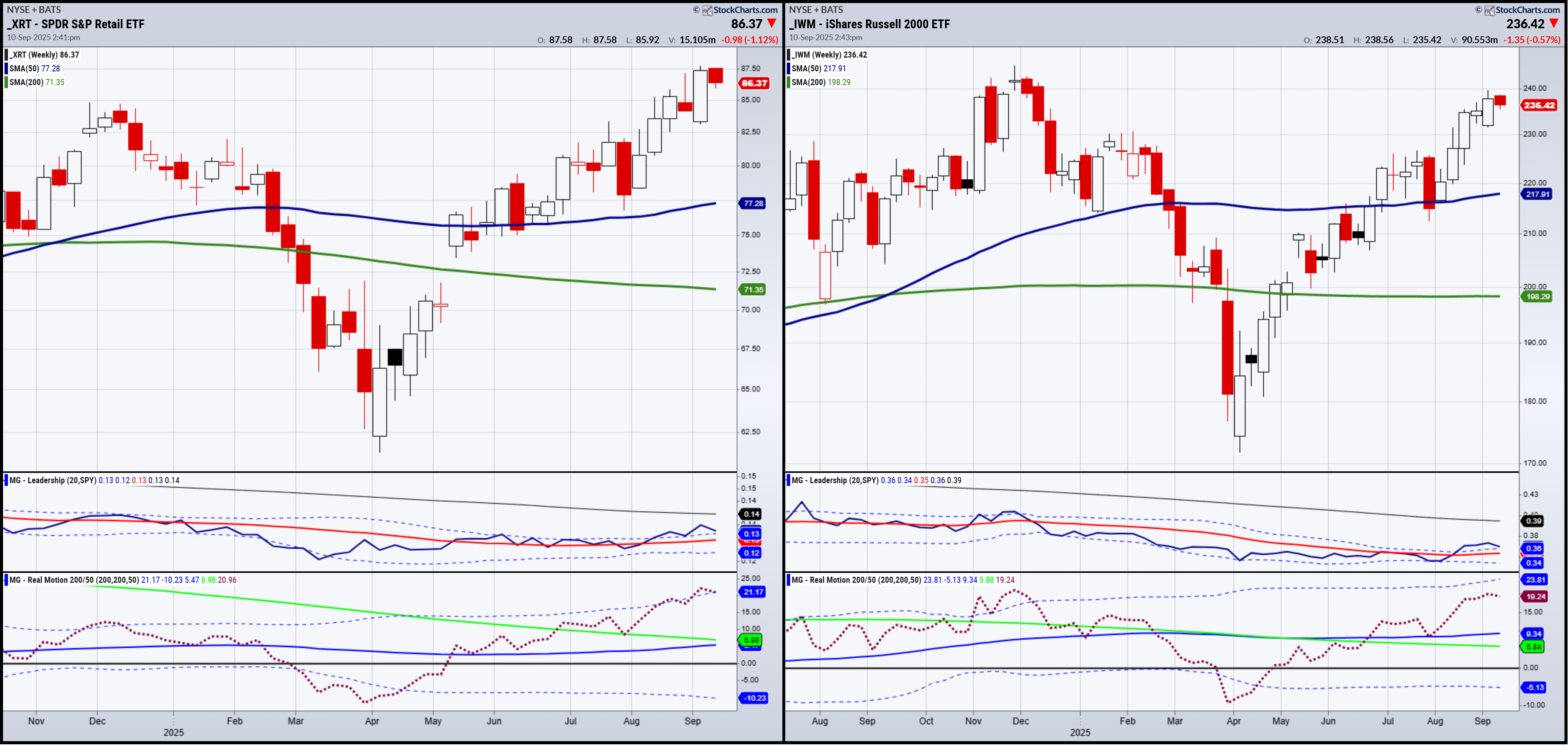

Granny Retail XRT is merely having an inside week meaning that this week’s range thus far is within last week’s trading range.

Same is true with Granddad Russell 2000 IWM.

What can we make of that?

More bullish than anything else as both are holding up. Both are outperforming the SPY. And both have good momentum.

Although, I would watch Granny as she has a bit of a sell mean reversion.

Big Brother Biotechnology IBB and Prodigal Son Regional Banks KRE are also both trading within last week’s range.

With SMH so decisive and everyone a bit indecisive but still in good shape, we now have price indicators to watch for.

Either IWM, XRT, KRE, IBB break out above last week’s range and continue to rally..OR

They fail the lows of last week’s range and take a trip closer to the underlying support near the 50-week moving averages (blue lines).

Sister SMH has done her thing.

I would assume, based on past performance when the market rotates back to growth, that she will hang tough unless the rest of the Family falters.

We see everywhere else in the Family this week, so we also must watch that SMH does not begin to look like a double top from her.

To sum up:

Educational purposes only, not official trading advice.

Limited offer.

Real-Time Trading with Mish

Hey everyone!

It’s been a moment since I’ve been sharing my insights on @Slice_App_, and I’m excited to invite you to join me on this journey! For those of you who haven’t subscribed yet, here’s your chance to dive in.

This is the only service where you can get my trades and trade management.

It will not last forever.

Looking forward to seeing you there!

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

-----Get your copy of

Plant Your Money Tree: A Guide to Growing Your Wealth

Grow Your Wealth Today and Plant Your Money Tree!

"I grew my money tree and so can you!"- Mish Schneider

Mish in the Media-Want to see more? All clips here

Weibo Mish in Mainland China talks silver and bitcoin 09-08-25

Financial Sense Metals Boom, Shiny 7, and Small Caps Outperformance 09-05-25

Schwab Network Mish talks about Bitcoin, energy and the vanity trade 09-03-25

The Street.Com Mish talks the metals, energy and consumer niche trades 09-03-25

10 Stock Picks Under the Radar Me and 9 other traders direct you to trades you might not think of 09-04-25

Coming Up:

Weekly podcast and appearances on Business First AM

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

The divergence between growth and value continues to widen

S&P 500 (SPY) 647 now support

Russell 2000 (IWM) 233 close support

Dow (DIA) 455 support

Nasdaq (QQQ) 575 support

Regional banks (KRE) 64 key to hold

Semiconductors (SMH) 293 support

Transportation (IYT) This is our weak link not even over the July range. Watch 73.50 to clear 70.00 to hold

Biotechnology (IBB) 140 pivotal

Retail (XRT) 84 support 87.58 new 2025 high but needs to clear

Bitcoin (BTCUSD) 107k good low to hold but still needs to clear back over 114k

Every day you'll be prepared to trade with: