June 21, 2011

Mish's Daily

By Mish Schneider

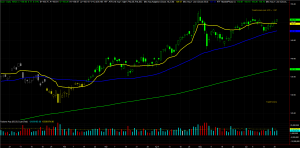

Beginning with IWM-if we go back to that March 15 low at 77.57 and look at the low that was made on June 16 at 77.23, we will also see that although it took out the March low, it held the 200 day moving average and closed above that March low. That was the day that it closed with a DOJI candle. We then spent the next couple of days consolidating and finally today had the gap higher with good follow-through and a close above the adaptive moving average at 80.22. We also had an accumulation day in volume. That's the good news. The news to be wary of is first the 50 day moving average actually declined further today. Second, is that we have good resistance at 80.76 based on the low for May 25 which was the bounce point before we had the fake out rally preceded by the dump. I like when I see clear daily chart points such as 80.76 since today's high was 80.77. Therefore, without thinking too much about next direction, ideally we should hold today's low at 79.42, test the adaptive moving average at 80.22 on the open and hold it, then continue the move up above today's high 80.77 thereby looking at the next level of resistance at the 50 day moving average now at 82.33. Otherwise, if we run into resistance on the open at the adaptive moving average at 80.22 and fail today's low, not such a healthy sign.

SPY closed up 1.4% breaking out of the resistance from the 128 area with today's low 127.75, and stopped just shy of the adaptive moving average at 129.70. Plus, although it had an accumulation day in volume, the relative volume compared to last Thursday and Friday is still low. The slope on the 50 day moving average in that index declined further. Though unlike IWM and QQQ, it never came close to testing the Spike low of March 16 at 125.28 so although it's been in an accelerating warning phase, that March low and the 200 day moving average have proven to be powerful support to date.

QQQ after holding support at around 53.63 for three days with an inside day yesterday, had the biggest gain seeing as it was the most oversold with 2.1% higher. Similarly, had an accumulation day in volume but just marginally higher than the average daily volume. It also has returned to a warning phase. It'll need another day above the 200 day moving average at 54.77 to confirm its move back to a warning phase so that is the first area that must hold tomorrow. Then, if it can clear 55.11, the adaptive moving average, it has a lot of room to the upside before it runs into major resistance at 56.75. Since that too has a declining slope on the 50 day moving average, will watch the 200 day moving average especially on a closing basis very carefully.

GLD underperformed the market and remains another interesting piece of the puzzle. The fact that it's held firm even with the market rally could indicate just how tentative this rally might be as nobody rushed out of gold with a big sigh of relief that everything is wonderful again in the world economy.

GLD underperformed the market and remains another interesting piece of the puzzle. The fact that it's held firm even with the market rally could indicate just how tentative this rally might be as nobody rushed out of gold with a big sigh of relief that everything is wonderful again in the world economy.

SLV** was lackluster closing higher on very light volume, and failing to get above the adaptive moving average. There's been no reason to go short at this time, but still a candidate for a sell off.

Finally, EURUSD now testing upper end of the range with resistance between 1.44 and 1.45. Clearly, 1.42 has proven itself as good intermediate support.

We began accumulating a bunch of long positions towards the end of last week and added a few of them today. I continue to encourage profit-taking at the targets, especially on those that are working off oversold conditions and not stacked and sloped. Furthermore, with so many stocks up on huge percentage gains today, will probably watch the indexes for further validation on whether or not today was the beginning of a summer rally or the rally into resistance with a resumption of a summer slump.

For more detailed analysis join me, along with hundreds of other subscribers, at Mish's Market Minute and get my daily trade picks, trade alerts, training videos, and exclusive analysis tools. Sign up for Mish's Market Minute now and get a free 2 week trial!

Every day you'll be prepared to trade with: