Last week we started this series on momentum looking at some of the characteristics of typical trades in the ETF models. Many of the best trades were at all-time or multi-year highs. But even the trades that weren’t on new highs had one thing in common, we tend to buy them on strength.

There are a lot of ideas about what works in trading and markets. Many will swear by “value” or “growth” investing or fundamental analysis or some key metric like the price-to-earnings ratio, book value, or year-over-year earnings or dividend growth. Still others might ignore these styles and metrics and focus exclusively on technical analysis and market timing. Each of these have their place in the trader’s toolbox and have proven useful with different applications or in different market conditions.

Is there one technique or approach that has an edge? James O’Shaughnessy’s best-selling book, “What works on Wall Street” is one of the best places to start researching this topic.

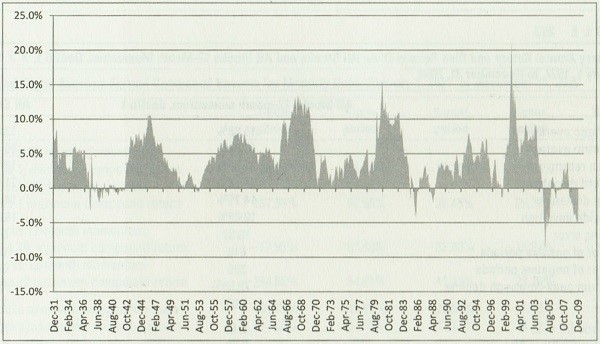

In his book, he takes a wide-view approach, looking at large amount of data from thousands of stocks between 1927 and 2009 and surveying multiple perspectives including fundamental and value investing to pure momentum.

As would be expected, each method has it merits and can work better or worse in different market conditions, however, buying stocks that have had the best price appreciation over certain periods proved to be the top performing and most persistent strategy in his large dataset.

For instance, O’Shaughnessy looked at ranking stocks with a simple six-month return and found that buying the top decile (top 10% of rankings) of stocks based on six-month return, over the entire sample period of 82 years resulted in an average annual return of 17.6% versus 13.1% for all stocks—a nearly 35% improvement in annualized return.

Furthermore, the top decile beat the all stocks group in 87% of all five-year rolling periods and 98% of all ten-year rolling periods (though it was not without some serious drawdowns and had several multi-year periods where it underperformed).