This week we made no position changes in the ETF Country model. Our current three positions are SSO, TMF, and IFN. To open next week, we will remain in those three ETFs.

The MSCI World Index closed the week up +1.52%. The ETF Country Plus model ended the week up +0.42%. The ETF Country Plus Strategy is up +15.03% year-to-date compared to its benchmark, the MSCI World Index, which is now up +6.12% year-to-date.

This Week’s Strategy Lesson: Halftime Report

We are now half-way through the year. Happy 4th of July to all of our U.S. subscribers. We thought we would take this opportunity to review the performance of the model so far this year.

The Country Plus model references two benchmarks. The ACWI is the primary benchmark we use. It is an ETF that tracks large and mid-capitalization developed and emerging market equities. This should give you similar performance to what you might expect if you were to hold all the possible ETFs in the Country Plus model at the same time in correct proportional size.

We also include the SPY as a secondary benchmark because it is more familiar and a more common standard performance benchmark. At times there can be a significant divergence between the two, but so far in 2014 they have tracked each other closely.

The Country fund has been a solid performer this year, more than doubling the performance of each of its benchmarks. We have seen a few more pronounced up and down swings, but overall our performance has never dipped below that of our benchmarks.

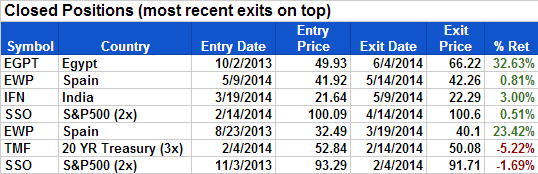

Closed Trades

EWP (Spain) and EGPT (Egypt), which we recently exited, were responsible for a large amount of the gains this year, with many of the other trades being a wash.

Open Positions

We are currently in TMF, the triple leveraged treasury. Treasuries have made a nice run, but appear to be at potential turning point. TMF flirted with breaking below its 50 DMA several times and in just the last two days made its most convincing move below it. This position will definitely be one to watch closely in the coming days.

The model entered SSO (SPY 2x) early June as the SPY began to break out of the sideways consolidation and into new all-time highs. That position continues to do well as the SPY has made several new daily highs through the month again as recently as Thursday on strong jobs and economic data.

Our last open position is IFN (India) which made a big move surrounding the political elections and a potential more business friendly environment going forward. This if our current best performing position and put in new recent highs on Wednesday.

The Current Condition of the Model

For the country model, we are in SSO, IFN, and TMF.

Here is a summary of the weekly performance of all the ETFs that the strategy monitors:

Best wishes for your trading,

James Kimball

Trader & Analyst

MarketGauge