December 7, 2014

Weekly Market Outlook

By Mish Schneider

Here’s a new idea. The Fed’s QE worked!

If you’re about stop reading in disgust at the thought of having to read such rubbish, let me assure you that you and I most likely agree on several other ideas such as...

If you’re about stop reading in disgust at the thought of having to read such rubbish, let me assure you that you and I most likely agree on several other ideas such as...

First, QE has created a massive problem in the form of an unprecedented expansion of the Fed’s balance sheet. And no one knows how this can be resolved pleasantly.

Second, the current recovery has been the feeblest on record (including Great Depression’s recovery) by many measures.

So maybe saying “QE worked” implies “better results” than most people would like to have seen over the last six years (myself included). But in the Fed’s defense, the problems that needed to be solved in the depths of 2008 were quite large (the longest and deepest recession since the Great Depression). So it's been a longer road to recovery.

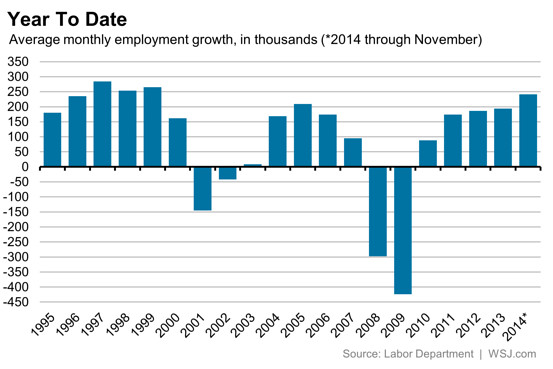

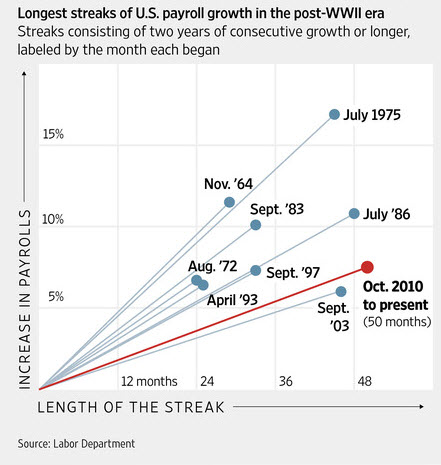

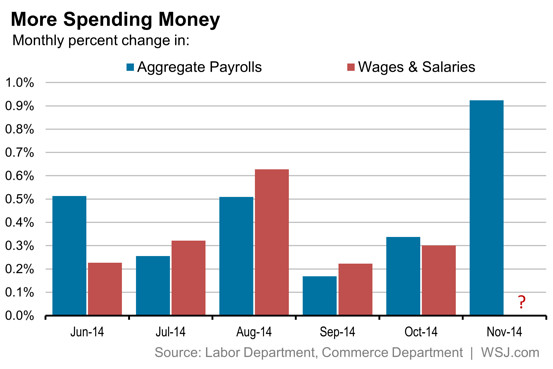

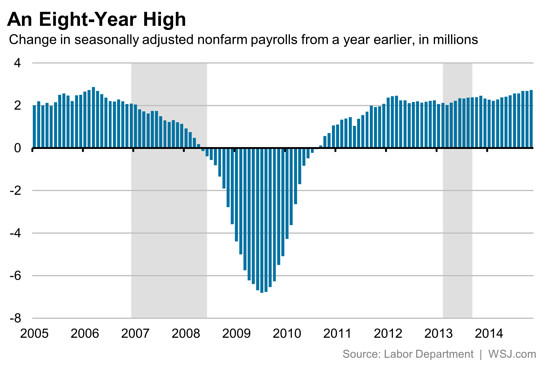

Friday’s employment data is clearly the best we’ve seen in a long time, and highlights some noteworthy longer term trends.

For years pundits have dismissed QE as having done little more than inflate assets like stocks and bonds, Friday’s data suggests that perhaps stocks have really been rising because the economy is stronger than many investors give it credit for.

And since employment is one of the most important trends that affects investors’ expectations of future corporate earnings, and then in turn, equity valuations…

This week I'll take a minute to look at some of the impressive employment data contained in Friday’s report, and what it means for your trading.

Faced with such good data, pessimist will argue that these strong gains are outliers, to which I say, the bigger picture is that positive trends are in place and acceleration is now a natural next step.

To pessimists who retorts, that stronger employment and accelerating wages will lead to Fed raising rates sooner rather than later, I say… we should welcome growth so strong that higher rates are needed, and…

Perhaps they should talk to ECB President Mario Draghi, who now faces the threat of a third recession since 2008 in the Euro Zone, and has finally decided to follow the Fed’s playbook of unprecedented QE. Better late than never.

Finally, as a father of 2, facing the high cost of college education, I found a little relief in this last chart showing that there is at least some statistical edge to earning that expensive degree. The jobless rate for people with a bachelor’s degree is 3.2%, much better than the 5.8% unemployment rate among people whose highest degree is high school, and 8.5% for those who didn’t finish high school.

As a trader looking at economic data is a nice exercise, but what matters most is how the market reacts to the data.

So the most important news on Friday was that despite great employment data, the market was hardly in the mood to party like it did in 1999 or 2006 when employment growth was this strong.

The most respectable move came from the financials (XLF). Healthcare (XLV) and semiconductors (SMH) acted well too. Unfortunately, these were the only standout sectors and they have been the leading sectors for months. This makes Friday’s market action very disappointing.

Therefore, Friday made it very clear that this market needs to be treated as several different markets based on each market sector. Be very vigilant of what sector your stocks are in going forward. There is definitely an edge to be had by being in the right one!

This week’s outlook video will look at the sectors to focus on right now, and a few other interesting markets set up with big trading opportunities.

Every week you'll gain actionable insight with: