Are We Seeing the Beginning of a Breakout in Granny Retail?

Written by Wade Dawson (Michele Schneider is away from the office)

Despite the fact that Michele Schneider is out of the office, I thought I'd include a couple of her market observations from earlier this month.

Granny Retail (XRT), a Economic Modern Family Member, and Mish's notes help to explain the day's price action.

Mish, What I'm Always Watching:

- The Economic Modern Family (IWM, XRT, KRE, IYT, IBB, SMH + BTC)

- Granny Retail rose 4.10% on Tuesday so the consumer is spending more money, most likely out of necessity for essential items.

- XRT is showing strength but is still below the 200-day moving average.

- S. Retail Sales Numbers will be released at 8:30 am EST, Wednesday, August 17, 2002. This data should clue us in more to the U.S. consumer.

- When you follow the Economic Modern Family, you'll see where the overall market is heading next, and now retail is breaking out.

- Inflation and higher prices are forcing consumers to spend more. Analysts expect to have improved retail sales, especially in the grocery market category.

- Consumers around the globe are being hammered by inflation.

- Savings rates and personal spending in the U.S. are impacted, as consumers struggle with spending more and rising prices.

- Economic Modern Family Daily Performance

- IWM -0.04%

- XRT 02%

- KRE 90%

- IYT 70%

- IBB -1.36%

- SMH -1.13%

- BTC 89%

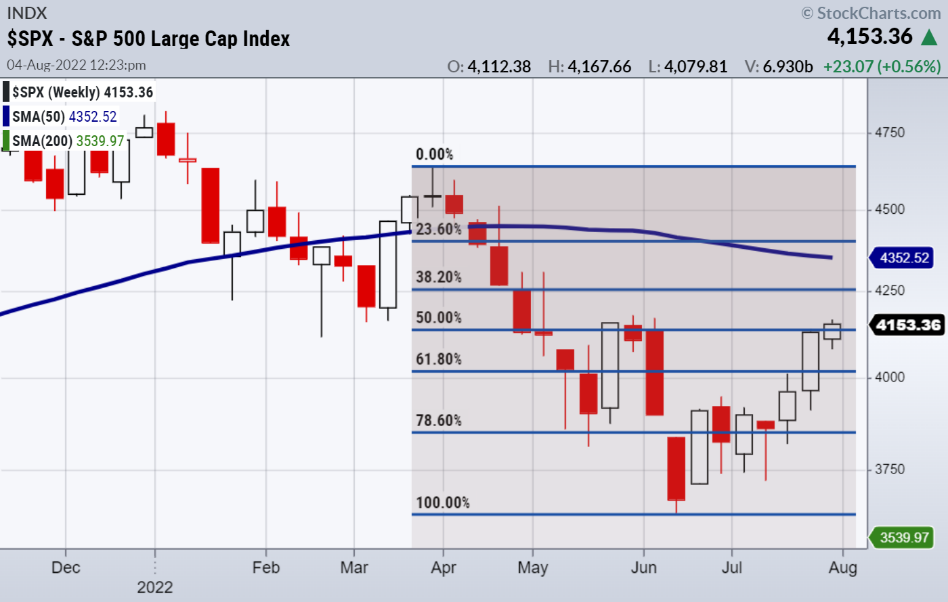

- There is overhead resistance over 4,260, and if the S&P 500 goes through this price level, it will be bullish for the current uptrend.

- My previous target for the short-term trend for the S&P 500 was 4,170, which is also approximately a hair above 50% of the previous downtrend beginning in April and bottoming in mid-June.

- Watch for divergences building in the credit markets and SPY and TLT.

- Watch Apple and Tesla if they can hold current price levels, broader bullish implication on the NASDAQ.

- The ARKK ETF is a good guidepost on disruptive tech, genomics, and robotics and a barometer of risk-on sentiment.

- Volatility and commodity price extremes are to be expected according to history in times of bullish commodity cycles.

Mish, What I Am Watching:

- Retail, Solar energy, EV Space, India, F&B, Natural Resources, Commodities, Transportation, Materials, Grains, Disruptive Tech, Industrial Metals, Uranium, Lithium, Rare Earth Metals, Biotechnology, Gaming, Autos, and Genomics.

Written by Wade Dawson, Portfolio Manager on behalf of Michele Schneider, Managing Director of MarketGauge and Director of Trading Education and Research at MarketGauge.com.

If you’re not a member and would like learn more about membership please let us know via live chat, phone, email, or book a private call with our Chief Strategy Consultant Rob Quinn by clicking here.

Get your copy of "Plant Your Money Tree: A Guide to Growing Your Wealth"

and a special bonus here

Mish in the Media

Fox-Making Money With Charles Payne 08-03-22

Trader Talks Biz First AM: Clover Health 08-03-22

Mish's midweek update: A trendsetting week in the markets Part 2 of 2 08-03-22

Bloomberg TV on Yields 08-02-22

Business First AM on ARKK 8-02-22

Cheddar TV on Big Tech 07-29-22

ETF Summary

S&P 500 (SPY) 431.99 now resistance with support at 427.17

Russell 2000 (IWM) 202.37 the resistance with support at 199.34

Dow (DIA) 343.62 resistance and support at 339.20

Nasdaq (QQQ) 334.80 1st level of resistance and support at 329.05.

KRE (Regional Banks) 69.02 resistance, support level at 67.85.

SMH (Semiconductors) 246.45 resistance and support at 241.83.

IYT (Transportation) 251.71 resistance and support at 247.21.

IBB (Biotechnology) 134.39 resistance point and 131.65 is support.

XRT (Retail) 76.15 resistance point and with support is at 71.65.