February 11, 2026

Mish's Daily

By Mish Schneider

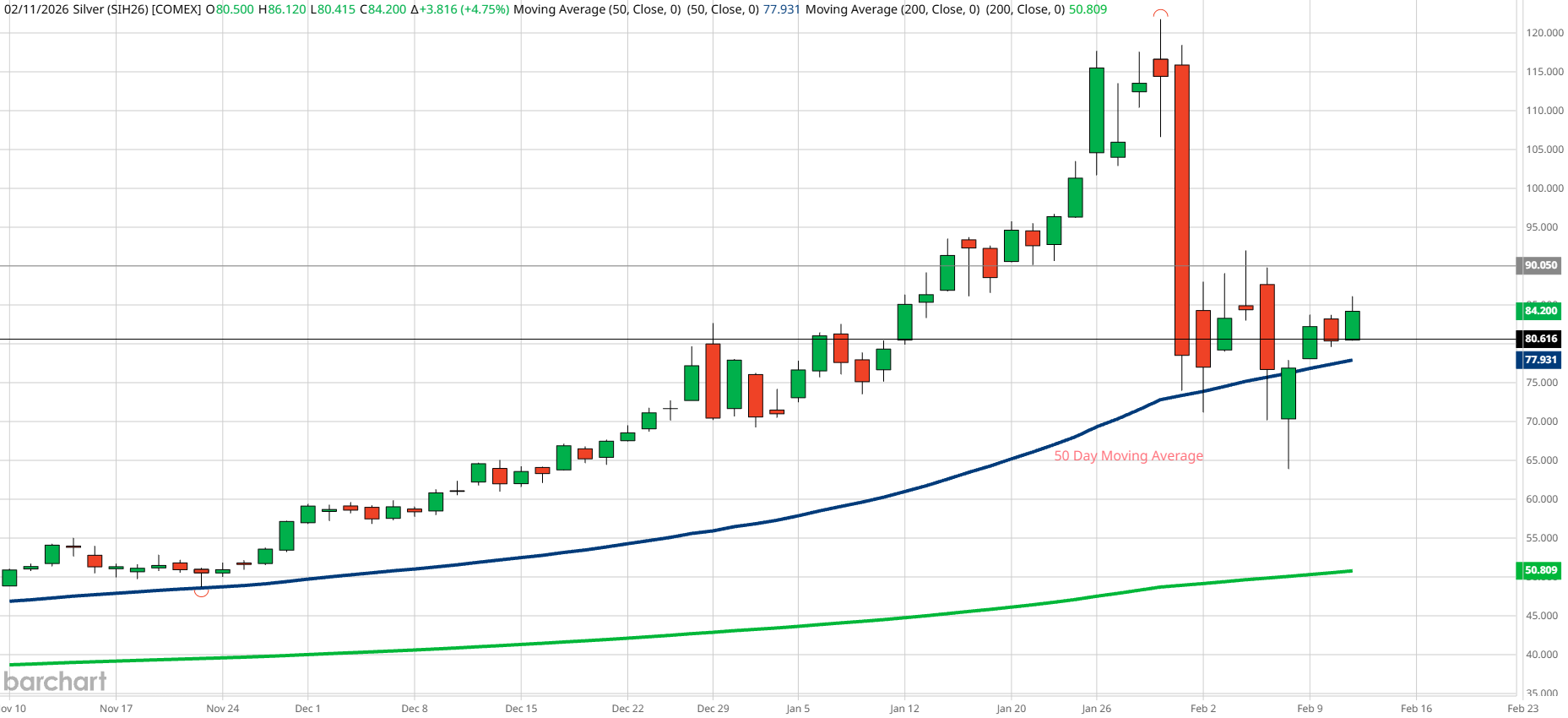

Silver has delivered both excitement and anxiety— surging higher in a volatile run and then stunning traders with a dramatic one-day selloff.

Since that shakeout, the metal has begun to stabilize, moving into a period of consolidation that could define its next major trend.

While the price action has been intense, the bigger picture for silver remains constructive.

The underlying fundamentals continue to lean bullish, with supply constraints and steady industrial and investment demand supporting the longer-term outlook.

In other words, the recent volatility has not changed the core story — it has simply reset expectations and levels.

Now that silver is calming down, this is where strategy comes into play.

Consolidation phases often create the best opportunities to develop a clear trading and investment plan rather than reacting emotionally to sharp moves.

.

The key technical level to watch on the downside is $80, which now becomes an important support zone. Holding above that level keeps the current bullish structure intact.

On the upside, a decisive move over $90 an ounce could signal renewed momentum and attract fresh buying interest. If that breakout occurs, silver has the potential to run back toward $110 or even higher over time.

As always, in Mish’s Market Minute, price leads the narrative — and silver’s next chapter will be written by how it behaves around these critical levels.

In this video, topics covered:

.

Note that this is different than our other YouTube channel featuring the Economic Modern Family.

That is for financial literacy.

Mish’s Daily of Mish’s Market Minute on the MarketGauge YouTube channel under “shorts” is meant for the more serious self-directed investor.

They do, however, overlap.

PLEASE, go to our YouTube Channel, watch the content we have shared to date.

👉 Watch. Like. Share. Subscribe.

.

To see our Financial Literacy Animated Series:

The Economic Modern Family is about to step off the page and onto your screen!

👉 Watch. Like. Share. Subscribe.

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

-----Get your copy of

Plant Your Money Tree: A Guide to Growing Your Wealth

Grow Your Wealth Today and Plant Your Money Tree!

"I grew my money tree and so can you!"- Mish Schneider

Mish in the Media-Want to see more? All clips here

February 10 Schwab Network Where We Believe Best Investments Lie

February 10 PreMarketPrep Joel Elconin Interview Granny Retail

February 10 CNA Asia First How Will the Market Resolve the Economic Data?

Coming Up:

February 12 Financial Compass

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) Back to bullish phase and near the highs-critical next moves

Russell 2000 (IWM) Failed 267 which might be a bit concerning

Dow (DIA) 49,600 needs to hold

Nasdaq (QQQ) 620 puts this back over the 50-DMA but under 610 again will be trouble

Regional banks (KRE) Sold off a bit so now has to hold around 70.00

Semiconductors (SMH) sister semis is back in the game with all time high 420

Transportation (IYT) 79 has to hold

Biotechnology (IBB) Good consolidation probably means higher in store if holds 170

Retail (XRT) Granny in an unconfirmed warning phase-if gets a second close under 88 could be concerning

Bitcoin (BTCUSD) 58k is the 200-week moving average. 72,500 place to clear and the good news is that the high volatility has cooled off some

Every day you'll be prepared to trade with: