July 21, 2011

Mish's Daily

By Mish Schneider

SPY came within a few ticks of filling the gap that was left on the island top day July 7. The low that day was 134.88 and today's high 134.82. Unless for some reason, we have a strong down move tomorrow, at this point it seems likely we will fill that gap thus negating the island top. That is a very good sign. Another good sign is the volume that came in today giving us an Accumulation day- the first one since July 15.

QQQ recent high 59.36 made on July 7. A close above that on a weekly basis gives the possibility of a significant move to the upside with an overall target of 66.

IWM as mentioned in last night's blog, once this cleared 83.50, we did indeed see the follow-through to the upside. Now looking for a move to test the recent highs at 86.82. 83.20 now key support.

Although the debt ceiling deal has not been agreed upon completely, I have found it impossible to fathom the possibility that our politicians would allow the stock market to collapse because of some bizarre notion that they are toting the party line. Without Wall St. support, the party for many of them would be over. I guess in a certain way we can be grateful for all of the politicizing since the dips have been incredible buying opportunities.

Featured ETFS:

GLD had a second inside day. Holding the fast moving average. Chart formation is still extremely strong and I would still be looking for an entry.

SLV** had an inside day. Forming a wedge which will break out above today's high.

SLV** had an inside day. Forming a wedge which will break out above today's high.

EWC target 33.20.

XRT did not perform as well as market but managed to hold above the fast moving average. Under today's low would start to look vulnerable. On the upside, above 55.45 next resistance at the all-time high of 56.

IBB wrote that a move above 107.30 would look positive and indeed it opened higher and proceeded to have a good rally. Now, must clear 109.47 at which point looking for a move up to 113.

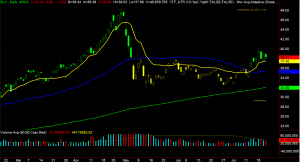

SMH a good lesson on why it is important to look at the longer-term trend and not just the daily chart. Now, the 200 day moving average is a factor and resistance. Clear that and it should fill the gap up to 34.03.

XLF came real close to the 50 weekly moving average. Will be interesting to see what happens there. Has been rallying for the last three days. The perfect scenario would be a close above 15.50 maybe even a move to 15.70 and then, a bit of consolidation in that range before a continued move up. Certainly, that would be helpful to the overall market.

For more detailed analysis join me, along with hundreds of other subscribers, at Mish's Market Minute and get my daily trade picks, trade alerts, training videos, and exclusive analysis tools. Sign up for Mish's Market Minute now and get a free 2 week trial!

Every day you'll be prepared to trade with: