August 10, 2011

Mish's Daily

By Mish Schneider

SPY Inside day. Big Volume but not a Distribution Day. However, under the 200 weekly moving average and S1. Therefore, will watch to see if it can take out today's high which would also take it back above the 200 weekly which would be awesome.

DIA Just closed above the 200 weekly with an inside day.

QQQ Nowhere near the 200 weekly, but same deal-inside day, needs to clear today's high if good.

IWM** Held S1-the only one that did with an inside day. Since it held S1, subs-use the instructions for that scenario that I write about under tonight's picks. Held the 200 weekly moving average at 66.01. Over today's high would get me thinking bottom in the near term.

ETFs:

GLD Monster-bought on the Opening range reversal right near support-took 2.5 off for daytrade and stayed with a miniswing position on balance.

SLV The low today was 37.19 and I wrote "back over 37.19. the short trend will reverse." And so it did. Bought SLV at 37.50 and still long for miniswing.

IBB SMH IYT still above 200 weekly moving average and all with inside days. I am following these sectors and groups carefully as they are digesting here and over today's high could be ready to run. Also add EMH XLY and EWT to that list.

IBB SMH IYT still above 200 weekly moving average and all with inside days. I am following these sectors and groups carefully as they are digesting here and over today's high could be ready to run. Also add EMH XLY and EWT to that list.

FCG still under the 200 weekly, but-has positive pivots tomorrow. So, over 18.41 getting interested.

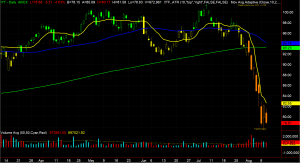

OIH** 2 Inside days. Held S1. Under the 200 weekly, but now would follow the range break as a better indicator.

TLT Under 107.62 confirmed with a break of today's low, could see a correction to 103 fairly quickly.

For more detailed analysis join me, along with hundreds of other subscribers, at Mish's Market Minute and get my daily trade picks, trade alerts, training videos, and exclusive analysis tools. Sign up for Mish's Market Minute now and get a free 2 week trial!

Every day you'll be prepared to trade with: