February 15, 2026

Mish's Daily

By Mish Schneider

How do you know when a stock or ETF has truly bottomed?

Not guessed. Not hoped for.

Actually bottomed.

There’s a simple signal professional traders watch for — and when it appears, it often marks the moment sellers are exhausted and buyers quietly step in.

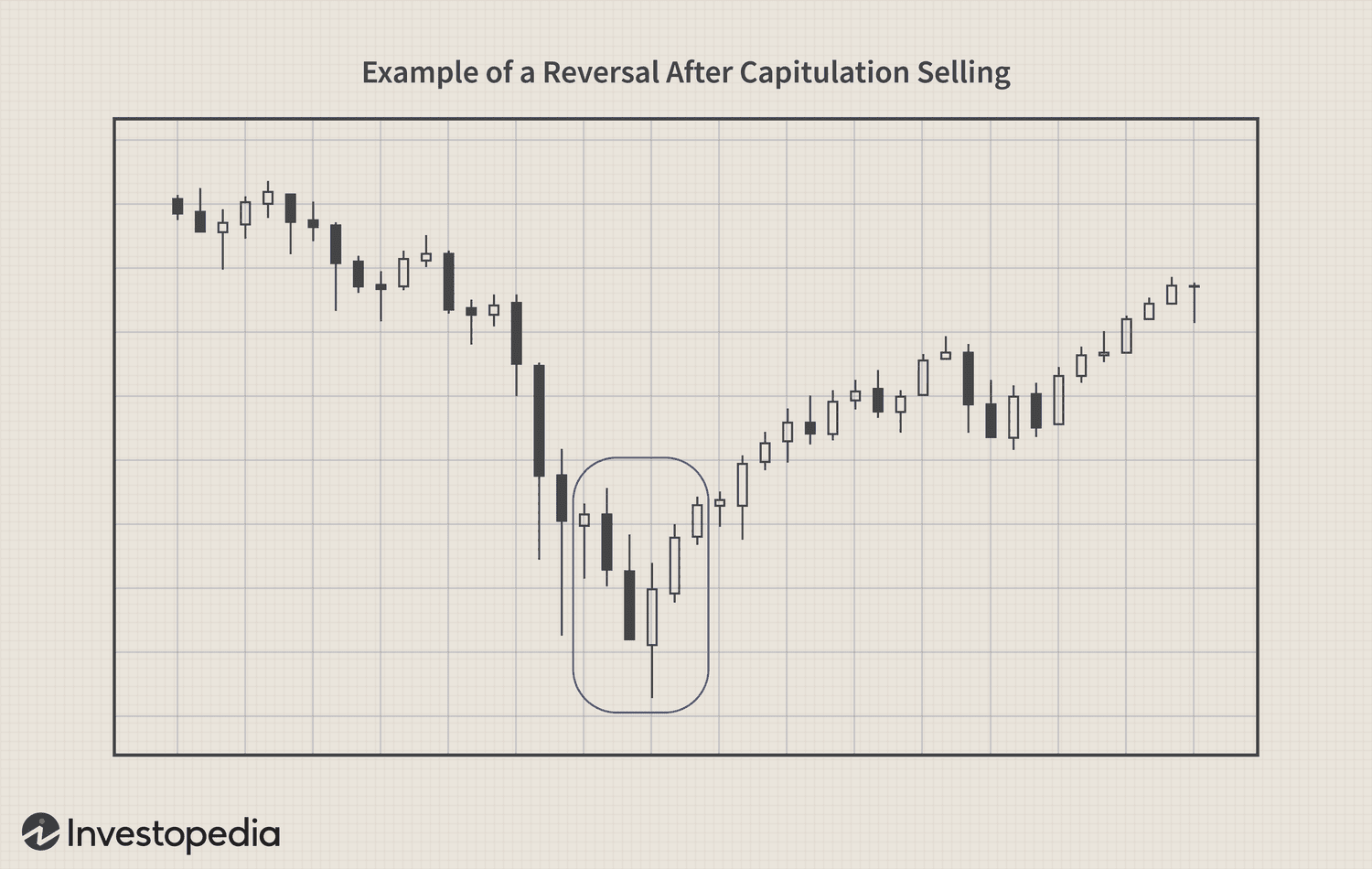

First, we want to see a new 60-day low.

That fresh low matters. It shakes out weak hands, triggers emotional selling, and creates what traders call capitulation. Without that flush, a real bottom is less likely.

But the low alone is not enough.

The next step is the real tell:

the very next day, price must break above the prior day’s high.

That’s the shift. Sellers pushed price down — but buyers immediately took control. When price can reclaim and exceed that prior high so quickly, it signals demand has returned.

.

Then we look to volume for confirmation.

A bounce on light volume can fail.

A bounce with a clear volume surge shows institutions and serious money stepping in. Volume is proof that the reversal has participation.

Finally — and this is the part that separates traders from gamblers — we define risk.

The stop goes right under the day of the 60-day low.

If price breaks that low again, the bottom isn’t in.

We exit quickly and keep capital protected.

This simple four-step process:

Video

.

Note that this is different than our other YouTube channel featuring the Economic Modern Family.

That is for financial literacy.

Mish’s Daily of Mish’s Market Minute on the MarketGauge YouTube channel under “shorts” is meant for the more serious self-directed investor.

They do, however, overlap.

PLEASE, go to our YouTube Channel, watch the content we have shared to date.

👉 Watch. Like. Share. Subscribe.

.

To see our Financial Literacy Animated Series:

The Economic Modern Family is about to step off the page and onto your screen!

👉 Watch. Like. Share. Subscribe.

.

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

-----Get your copy of

Plant Your Money Tree: A Guide to Growing Your Wealth

Grow Your Wealth Today and Plant Your Money Tree!

"I grew my money tree and so can you!"- Mish Schneider

Mish in the Media-Want to see more? All clips here

February 12 A Kind Company Stock Pick

February 11 Financial Compass Uncertainty Hits the Market

February 10 Schwab Network Where We Believe Best Investments Lie

February 10 PreMarketPrep Joel Elconin Interview Granny Retail

Coming Up:

February 19 Financial Compass and Business First AM (weekly)

February 20 Yahoo Finance

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) Even with Fridays bounce, still in a warning phase

Russell 2000 (IWM) Fridays bounce created an inside day, Tuesdays move is critical in the now leader

Dow (DIA) 496 needs to hold

Nasdaq (QQQ) Even with Fridays bounce, still in a warning phase and under the January calendar range low

Regional banks (KRE) 68 support to hold but still in good shape

Semiconductors (SMH) sister semis is back in the game but must clear the all-time high 420

Transportation (IYT) 79 Held so good

Biotechnology (IBB) Good consolidation probably means higher in store if holds 170

Retail (XRT) Granny trying hard to hang in there-this sector is a MUST watch

Bitcoin (BTCUSD) 72,500 place to clear and the good news is that the high volatility has cooled off some

Every day you'll be prepared to trade with: