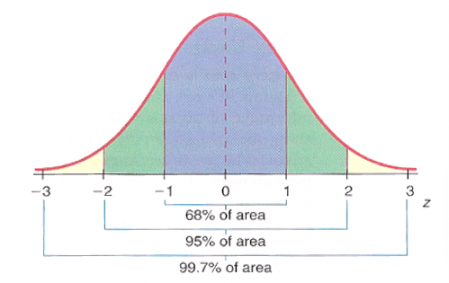

The graph above is of a normal distribution or bell curve. The blue area marked between -1 and +1 represents 68% of the total area of the curve. For normal distributions, 68% of all observations fall within +/- 1 standard deviation of the average.

If the average male height in the U.S. is 5’9’’ and the standard deviation of male height is 3 inches, then we know that 68% of all adult males in the U.S. will be between 5’6’’ and 6’0’’ (plus or minus 3 inches from the average).

Since in a normal distribution most of the observations are clustered around the center, it only takes 3 standard deviations to cover 99.7% of the observations. Going back to the height analysis, we could be rather confident that 99.7% of all adult males in the U.S. are between 5’0’’ and 6’6’’ (plus or minus 9 inches from the average).

Not everything is normally distributed. Income or wealth is not normally distributed. It tends to have “fatter tails,” meaning you see more people at the extremes than you would normally predict if it were normally distributed. Try your hardest, you will probably never run into a 50 ft. tall human in this universe or a parallel one, but you might run into someone worth $50 billion.

Stock returns are not strictly normally distributed, but most of the time we can use standard deviation as a good approximation. In finance, it is used for this purpose for three reasons: it works most of the time, the calculations are clean and simple and because we don’t actually know the real distribution of stock returns (and that distribution is probably not constant, fluctuating under different market conditions).

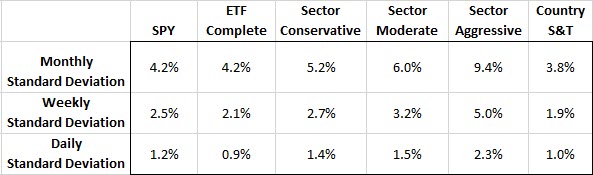

Similar to our height example, we can take stock returns (daily, weekly, monthly, etc.) and use a standard deviation calculation to determine the range and dispersion probabilities.