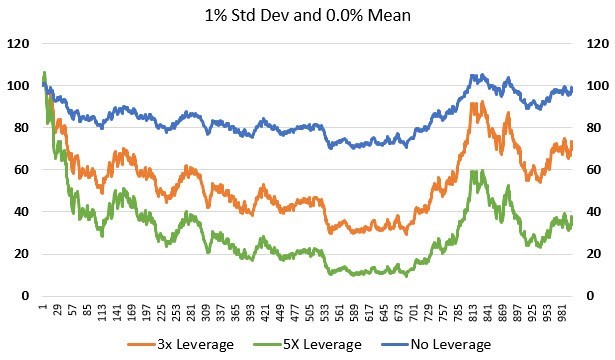

If we repeat the same process to generate another list of 1000 random numbers with the same zero average but now with larger 1.0% standard deviation, we can see the direct effect of the increased volatility.

In this scenario, the “no leverage” based on the random numbers happened to end the period mostly flat, down -2.8%. While, off the same baseline numbers, the “3x leverage” ended down -30% and the “5x leverage” ended down -65%.

While this isn’t a perfect “apples to apples” comparison, the increased volatility of going from 0.5% standard deviation to 1.0% standard deviation in our two scenarios increased the “decay” in the “3x leverage” from -7% to -30%. For the “5x leverage” it went from -22% to -65%.

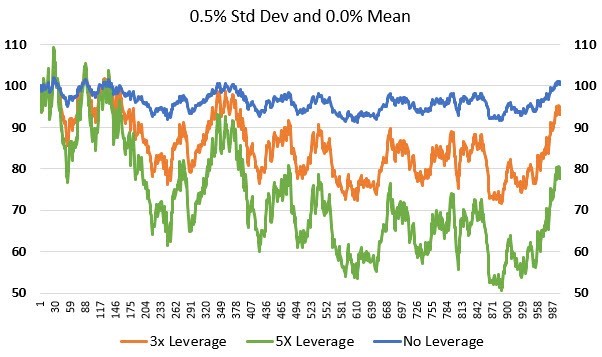

We intentionally used large values in terms of the amount of leverage, the amount of volatility, and the number of compounded periods to help demonstrate the underlying mechanics. Scenarios with small differences in these values can make it harder to spot the effects. You have to use some combination of lots of leverage, or lots of volatility, or lots of periods to get these drastic differences.

Different Effects in Different Markets

So far we have looked at how the application of volatility can affect decay rates in scenarios where the market ends mostly flat. However, when we have directional markets, the leveraged daily compounding can have different effects.

In down trending markets, the leveraged compounding tends to reduce losses to lower than what you might expect with a simple multiple applied to the final return in the non-leveraged portfolio (though you still have to be careful about leveraged portfolios having exaggerated or critical drawdowns that can’t be weathered while the drawdown in the non-leveraged portfolio is quite reasonable).

In up trending markets, the leveraged daily compounding can dramatically increase our return over a simple multiple of the non-leveraged return value.

Next week we will walk through a few of these examples to see the real-world positive and negative effects of leverage and compounding.