October 7, 2025

Mish's Daily

By Mish Schneider

GRANNY RETAIL STUMBLES BELOW SUPPORT

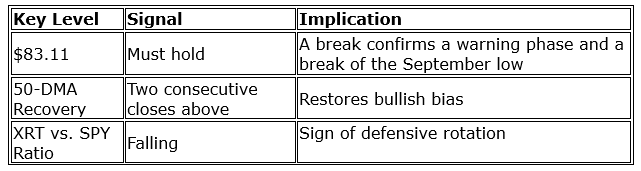

Granny Retail (XRT) just lost her grip on the 50-day moving average, a key short-term support level that often marks the line between healthy pullbacks and trend reversals.

This isn’t just a technical trip — it’s a sentiment signal that the American consumer, long the backbone of this market, may be running low on gas.

If XRT can’t recover quickly, we could be looking at a phase shift from Bullish to Caution, and possibly even to Distribution.

WHY IT MATTERS FOR INVESTORS

Retail sits at the center of the Economic Economic Modern Family — the pulse of the consumer and, by extension, the broader economy.

When Granny Retail weakens, it often precedes broader market fatigue.

Investors should pay attention because consumer spending drives 70% of U.S. GDP — when Granny sneezes, the market catches a cold.

Furthermore, KRE of the Regional Banks sector, already showed us signs of weakness with only a shallow bounce following news of Fifth Third Bank’s acquisition of Comerica Bank.

KRE has to hold around 63.00

The timing of this failure is crucial. The Fed remains caught between easing inflation and sustaining growth. Retail softness may be the first crack in the “soft landing” narrative.

If Granny Retail continues to weaken, the Fed’s path to rate cuts could narrow — not because inflation is roaring back, but because growth is rolling over.

TECHNICAL WATCHLIST

Keep an eye on COST, TGT, WMT, and AMZN — leadership in these names will determine whether the consumer narrative stabilizes or cracks further.

Also watch IWM (Small Caps) for confirmation; if both fail simultaneously, the risk-on trade could unwind quickly.

TAKEAWAY

Granny Retail’s stumble below the 50-DMA isn’t just another chart event — it’s a warning flag.

Retail stocks often lead turns in both directions.

If the consumer is finally feeling the strain, the next few weeks could tell us whether this market still has the spending power to sustain the rally — or whether the Family matriarch just signaled it’s time to take some profits.

Educational purposes only, not official trading advice.

Limited offer.

Real-Time Trading with Mish

Hi,

For some time now, I’ve been sharing my knowledge and mentoring investors on Slice: a platform built for real connections between mentors and investors. On Slice, you can:

To make it easy for you to join, I’m sharing an exclusive offer:

Your first month is only $1 with this promo code: “Mish1”

Join Slice Today. I’d love to connect with you directly and continue growing together as investors.

Warm regards,

Mish,

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

-----Get your copy of

Plant Your Money Tree: A Guide to Growing Your Wealth

Grow Your Wealth Today and Plant Your Money Tree!

"I grew my money tree and so can you!"- Mish Schneider

Mish in the Media-Want to see more? All clips here

BFM89.9 Radio A Small Crack to consider in this rally. 10-03-25

Business First AM The Trifecta of Inflation Trading Tips 10-03-25

The Money Path with WealthWise Mish Talks Q4, Semis, Gold and Fed Direction 10-01-25

Coming Up:

October 8 AAII NY Chapter

October 9 Phoenix TN China

October 10 Podcast Financial Sense

October 20-22 Mish will be in studio in NYC! Stay tuned.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 665 near term support

Russell 2000 (IWM) 239.40 last week’s low

Dow (DIA) 460.84 last week’s low.

Nasdaq (QQQ) 596.10 last week’s low

Regional banks (KRE) 63.00 needs to hold

Semiconductors (SMH) 322.43 last week’s low

Transportation (IYT) 70 huge support Thru 73 interesting

Biotechnology (IBB) 148 support

Retail (XRT) Unconfirmed caution phase

Bitcoin (BTCUSD) 119,000 support

Every day you'll be prepared to trade with: