October 1, 2025

Mish's Daily

By Mish Schneider

The trifecta of inflation” usually refers to the three core drivers that push inflation higher at the same time, creating a stronger and often stickier inflationary environment

According to Economists, the trifecta they refer to are

Then, there is the trifecta of inflation that I use, which stems from the price direction of hard assets.

This is a trader’s perspective. Keep these in your mind!

The U.S. dollar has declined ~10% in 2025. This tends to fuel import inflation and asset-price inflation (commodities, precious metals) in dollar terms.

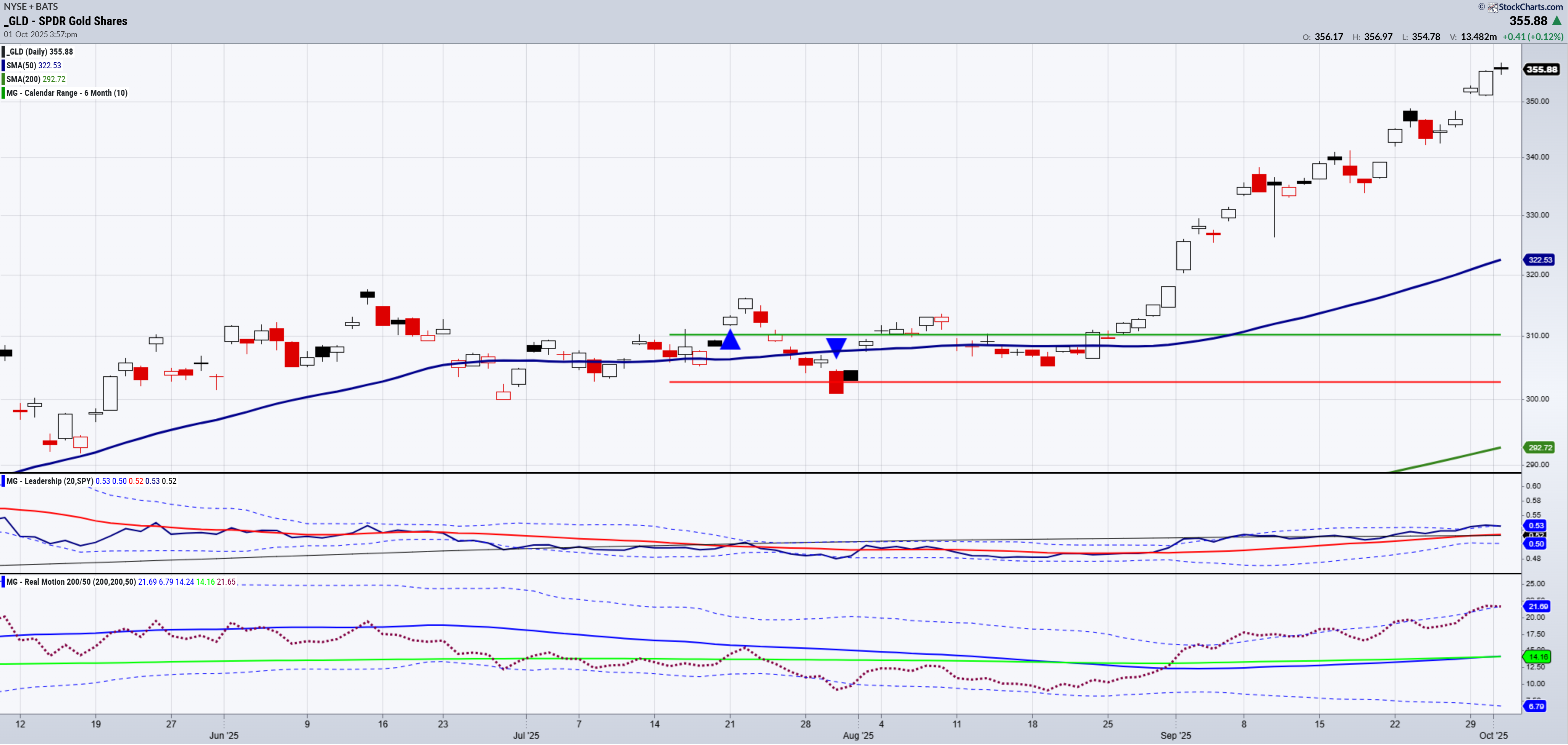

Both the gold chart (now on new highs) and the decline in the dollar well supports my trifecta.

In 2025 so far, silver has outpaced gold in returns.

The strength of this ratio indicator, as part of the trifecta, supports inflation expectations, especially when paired with dollar weakness.

As for fuel, lets look at sugar and oil…

Instead of rising, sugar prices are down: as of September 2025.

Sugar has fallen ~16.99% year-over-year.

The sugar leg does not confirm my inflation signal.

However, because sugar is more volatile and sensitive to weather, a future reversal could still flip that leg later.

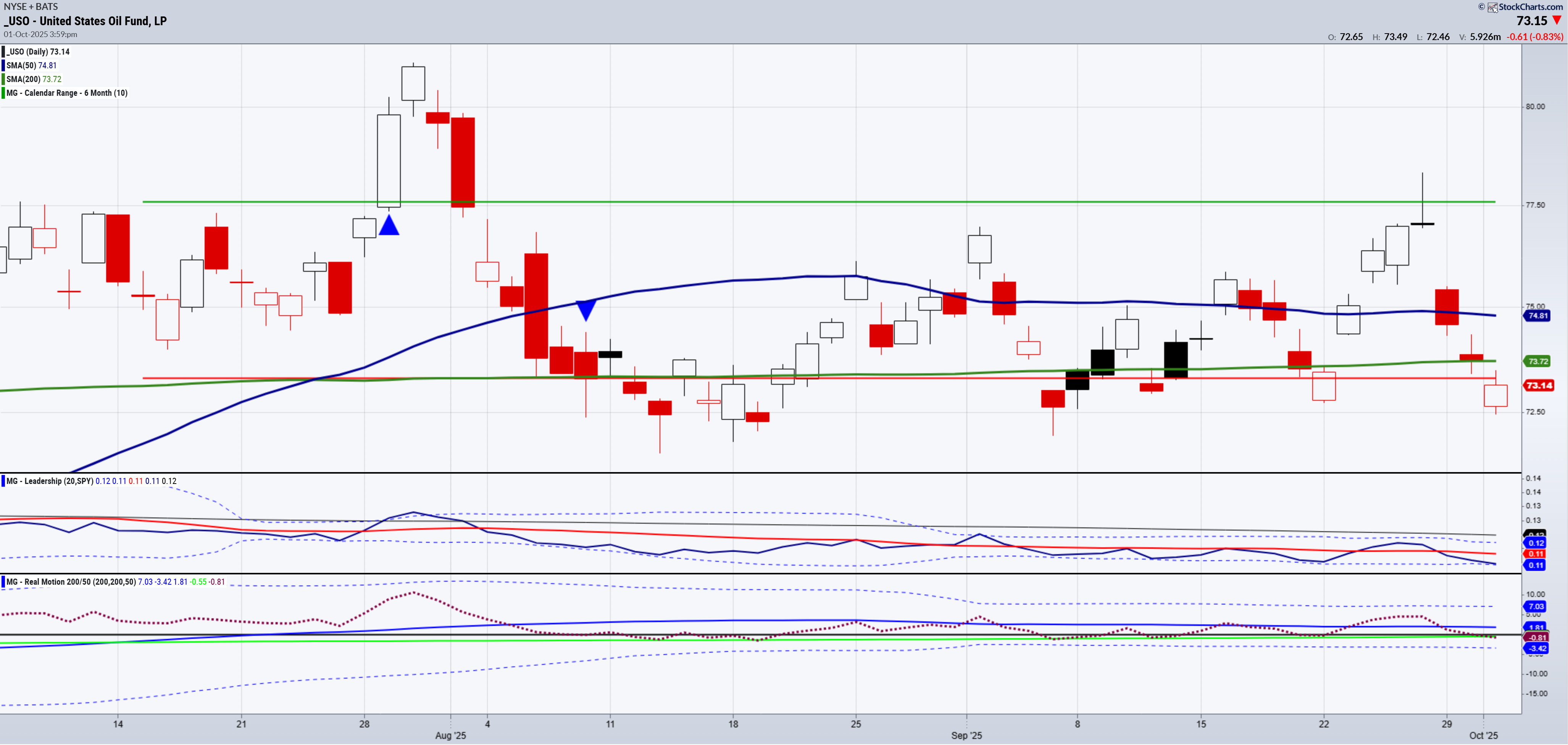

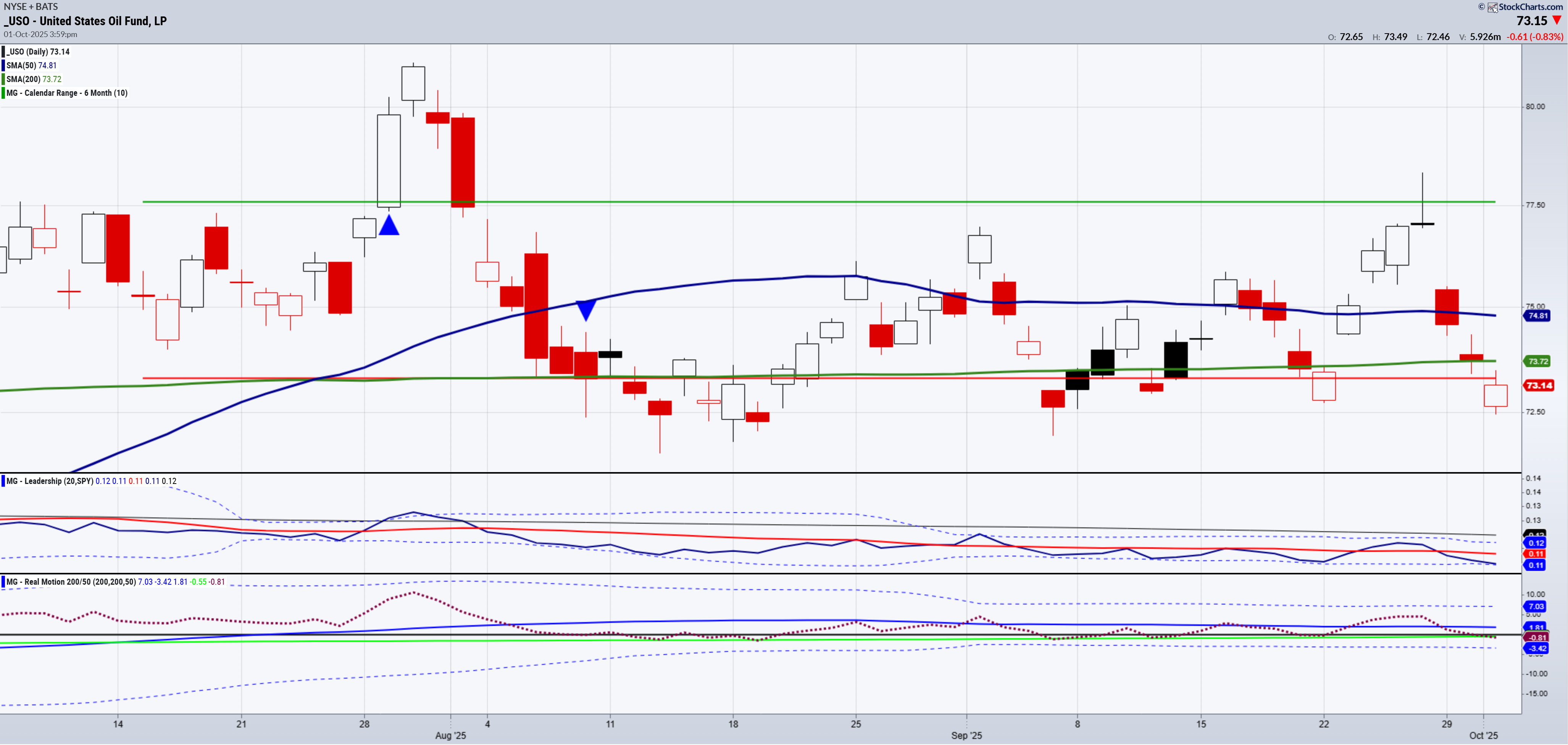

I am adding oil as a fuel, which can also be said about sugar, both as a biofuel and as a food additive.

In my “trifecta of inflation,” oil isn’t one of the three signature tells (dollar, silver/gold, sugar), but it acts as a shadow driver:

Oil prices have been volatile, swinging with OPEC+ supply decisions, U.S. shale output, and Middle East risks.

Even when not spiking, the threat of oil shocks adds to the inflation premium in markets.

If oil sustains above ~$90–100/barrel, it would re-ignite broad inflation fears

The takeaway:

With two of my three indicators signaling and oil acting as a reinforcing fourth, inflation risks remain elevated even without sugar’s confirmation.

If sugar joins the rally alongside oil, the market should brace for a stickier, multi-sourced inflation cycle that echoes past inflationary eras — and challenges the Fed’s easing narrative.

Educational purposes only, not official trading advice.

Limited offer.

Real-Time Trading with Mish

Hi,

For some time now, I’ve been sharing my knowledge and mentoring investors on Slice: a platform built for real connections between mentors and investors. On Slice, you can:

To make it easy for you to join, I’m sharing an exclusive offer:

Your first month is only $1 with this promo code: “Mish1”

Join Slice Today. I’d love to connect with you directly and continue growing together as investors.

Warm regards,

Mish,

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

-----Get your copy of

Plant Your Money Tree: A Guide to Growing Your Wealth

Grow Your Wealth Today and Plant Your Money Tree!

"I grew my money tree and so can you!"- Mish Schneider

Mish in the Media-Want to see more? All clips here

The Money Path with WealthWise Mish Talks Q4, Semis, Gold and Fed Direction 10-01-25

Pre-Market Prep The Party Continue Til This. 09-29-25

CNBC Squawk Box Asia Mish discusses inflation, risk and why oil is the X factor 09-29-25

Coming Up:

Weekly podcast and appearances on Business First AM

Vacation October 2-6, October 16-24

October 20-22 Mish will be in studio in NYC! Stay tuned.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 654.41 last week’s low 664 near term support

Russell 2000 (IWM) 237.50 last week’s low

Dow (DIA) 457.50 last week’s low. 462 near-term support

Nasdaq (QQQ) 588.50 last week’s low 663 near term support

Regional banks (KRE) Warning Phase-should be watched

Semiconductors (SMH) 322 support

Transportation (IYT) 70 huge support Thru 73 interesting

Biotechnology (IBB) 143 now support

Retail (XRT) 87 now resistance 84 support

Bitcoin (BTCUSD) Back in an unconfirmed bullish phase with 113,800 support

Every day you'll be prepared to trade with: